Introduction

If you are looking for a simple, cheap, and effective way to diversify your investment across thousands of securities, ETFs may be the answer you are looking for.

ETFs are rapidly growing in popularity, as are the annual profits they yield for their investors. Trading options, such as shorting ETFs or tracking global indexes, are increasing and adapting to provide an innovative investment solution. Traders can invest in a considerable number of securities simultaneously while only needing ownership of the ETF itself, resulting in fewer fees. Choosing which ETF to invest in requires careful research and selecting the right online broker.

What Is An ETF?

An ETF (“exchange-traded fund”) is a security that can be bought and sold on the stock exchanges and various online brokers. Think of an ETF as a personalized index of stocks and shares. Its value derives from the assets it tracks. ETFs can have as few as one asset or as many as thousands, and they are not bound by one particular marketplace.

ETFs will often consist of stocks, commodities, and other securities from the same industry. Investing in ETFs are a great way to diversify, and, unlike mutual funds, you can trade on them throughout the day. Here are five of the most popular ETF types:

Stock ETFs: Stock ETFs are made up of a range of stocks from a particular sector, such as technology or energy. A stock ETF will give the investor diversification in a specific sector without owning any stocks. As a result of only investing in one asset, ETFs do not incur as many trading costs.

Bond ETFs: To invest in individual bonds, you would usually go through a bond broker. Bond ETFs allow investors to circumnavigate this by trading on many well-known indexes, such as the London Stock Exchange. It’s much easier to invest in a bond ETF than a traditional bond; they have lower fees and taxes. It is no surprise that Bond ETFs are a rapidly expanding investment option and are close to netting traders 2 trillion dollars in a year.

Industry ETFs: Industry ETFs track stocks from industries such as transportation, aerospace, construction, defence, and engineering. Instead of just using the major indexes for industry within a specific country, industry ETFs are now going global to provide greater diversification, performance, and stability. You are also currently able to leverage funds in the form of CFDs (“contracts for difference”) or short a fund (bet against it), depending on which online broker you are using.

Currency ETFs: There is no need to set up trades for multiple currency pairs individually by investing in a currency ETF. Traders can purchase a currency ETF, like any other stock on an exchange, as a collection or “basket” of currency pairs. Although traders cannot control the specific currency pairs bought and sold within an ETF, the ETFs are carefully managed to deliver high-profit potential and diversification.

Commodity ETFs: Commodity ETFs give traders quick, cheap and easy access to many commodities within an indices or subindices. Commodities are often viewed as a risky investment compared to the stock market, but they are a brilliant way to diversify your portfolio. The best commodity ETFs can typically bring in around 40% per annum profits. Bloomberg has a well-known commodity ETF that tracks between 20 and 25 commodities, including metals, energy, livestock and agriculture.

How To Trade An ETF

Traders can purchase ETFs the same way you would buy stocks and shares through an exchange. You can also choose whether you want to “long” or “short” your investment. “Long” means you believe the ETF’s price will go up, and “short” means you feel the ETF’s price will go down. Although buying an ETF is very similar to trading ordinary stocks, there are some strategic differences to investing in ETFs that are well worth knowing.

It is recommended only to trade ETFs when the “underlying market” (the market on which the ETF is based) is open. If you trade during the underlying market’s opening hours, you will have a much better sense of how the market is behaving and the subsequent effect on your ETF’s price. Similarly, it would help if you tried to avoid buying ETFs too close to its related market’s opening or closing times. It can take a while for the markets to “warm up” and “cool down”, which means it’s volatile to invest.

You should always set a stop-loss and take-profit in all trading, but it is also a good idea to use limit orders with ETFs. Although market orders will tend to be processed faster than limit orders, a limit order will guarantee you the entry and exit price you are looking for. You are less likely to get ripped off on the exchange by using limit orders, but there may be times when speed is of the essence, so you will have to use your discretion.

Which ETF Should I Invest In?

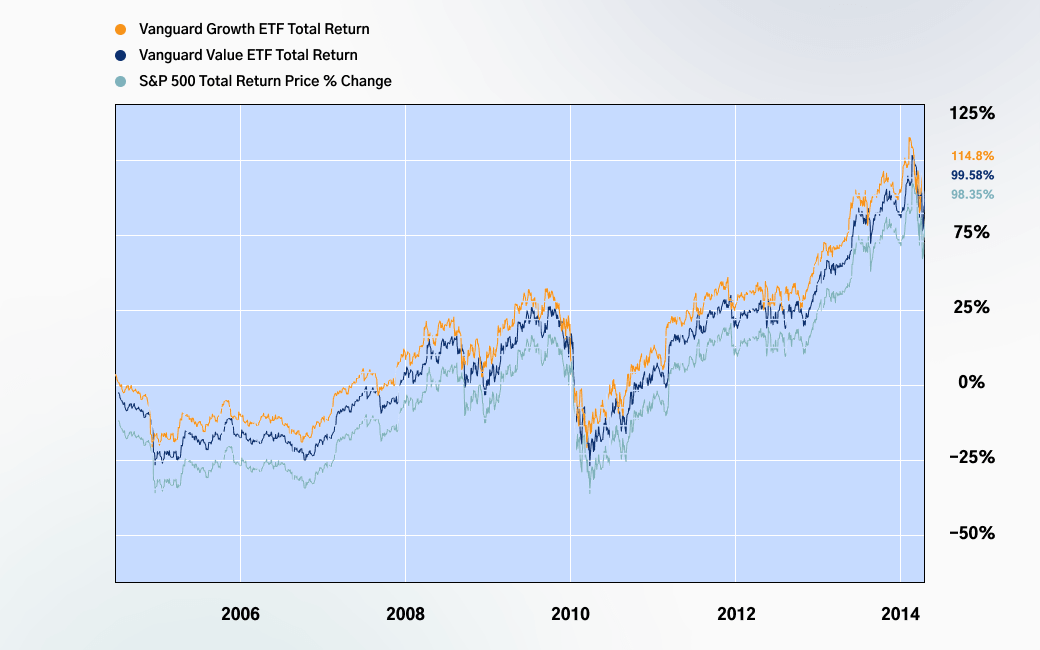

Some big names in the ETF world have achieved tremendous success. Vanguard Growth ETF, Invesco QQQ Trust, and iShares Russell 1000 Growth ETF are some examples. All these ETFs track different market sectors. The Vanguard Growth ETF follows the CRSP US Large Cap Growth index, whereas Invesco is closely tied to the NASDAQ 100 index. These are ETFs that have performed exceptionally well over the years, and they have a proven track record for any interested investors.

Having the best historical performance does not necessarily mean achieving the best figures next year or coming years. It is often the lesser-known or newer ETFs which outperform the titans of exchange-traded funds. Reality Shares Nasdaq NexGen Economy ETF was only started in 2018, and it has made massive profits, partly through its cryptocurrency investment.

You will need to research the markets carefully at the time of investing and find the ETF which you believe best matches the future of the markets. Aside from keeping your finger on the pulse with world and market news, learning how to interpret price charts will help indicate which ETF will serve you best.

Which Is The Best Online Trading Platform?

Although we can’t say with certainty which will perform best, we can guarantee the quality of your experience with our online trading broker, “TradeOr“. TradeOr has a fantastic range of in-built features and functionality. From enabling you to place orders, take profits and stop-losses to viewing price charts and even setting up CFDs (“contracts for differences”), TradeOr has it all, including ETF trading! If you are interested in investing with TradeOr, feel free to contact one of our customer service team, who can help 24/7.

Conclusion

An ETF offers many benefits to traders looking for a quick and cheap way to diversify their portfolios across hundreds or thousands of assets. There are many types of ETFs to familiarise yourself with, and there are some strategic differences to learn about when trading ETFs. No one can say for sure which ETF is going to perform best going forward, but there are some successful names in the industry and tools for determining the best ETF option. If you are looking for an online broker through which you can invest in an ETF, TradeOr is a fantastic all-in-one trading solution. It’s free to register, and our customer support team are happy to answer any questions you may have!

FAQ

- What is an ETF?

"ETF" stands for "exchange-traded fund", and it consists of numerous (sometimes thousands) securities whose prices it tracks to create its value. An ETF can be bought and sold via an exchange as an individual security, in the same way as you would purchase a stock. ETFs are privately managed and cannot be changed by traders. ETFs offer traders diversification and a cheap and simple alternative to buying a large number of assets one by one.

- What are the different types of ETF?

An ETF is not limited to a single market or sector. ETFs will generally attach themselves to either stock, bonds, currencies, commodities, industries or a few others. Think of them as an index but with a bit more freedom. They will often closely track an index, just as Invesco's ETF does with the Nasdaq 100.

- How do you trade ETFs?

Trading ETFs works in the same way as trading any stock from the stock market; you can "long" or "short" your investment. That does not mean you should approach trading ETFs in the same way. It is advisable when trading ETFs only to open a trade when the underlying market is open and not too close to the opening or closing time. You should also set trade orders (as opposed to market orders) if you want to get a better exchange rate.

- Why should you invest in an ETF?

There are two big reasons why investors choose to purchase ETFs. The most obvious advantage is that an ETF provides instant diversification. The second major benefit of using ETFs is it is a considerable cheaper route compared to individually purchasing the assets an ETF is tracking. The trading costs and tax implications of opening hundreds or thousands of separate purchases make ETFs an attractive alternative.

- Which is the best ETF trading platform?

We hope you consider our trading platform, TradeOr, in your hunt for the best ETF trading broker. We have many essential ETF trading features (such as stop-losses and limit orders), a fantastic range of marketplaces, trading software and charting tools, as well as competitive fees and high leverage rates on CFD trades. Please don't hesitate to contact our friendly and responsive customer service team if you have any questions.