Key Takeaways:

- Spot trading and leveraged trading are two key ways to approach financial markets

- Trading on margin, or leverage, is the preferred way for many to invest in the markets

Understanding Spot Trading

What is spot trading in financial markets and how can you transition from it to leveraged trading? This is one of the first decisions a new trader should make. Not only will this narrate your trading experience, it will also allow you to approach the market differently and get different results.

So, what exactly is spot trading? Essentially, spot trading gives you the ability to purchase anything “on the spot”, or right at the moment, at the current price. By definition, spot trading does not involve the use of leverage. In other words, you get to purchase your asset of choice only with the amount of funds you have in your account.

In practice, when you trade on the spot market, the exchange happens at the exact moment the trade is settled. Spot trading happens in every market, from currencies, to stocks. The price at which the trade settles is called spot price.

Apart from spot trading, there are also options and forwards. Generally, traders prefer to trade on the spot market as it costs less and it’s easier.

Understanding Margin Trading

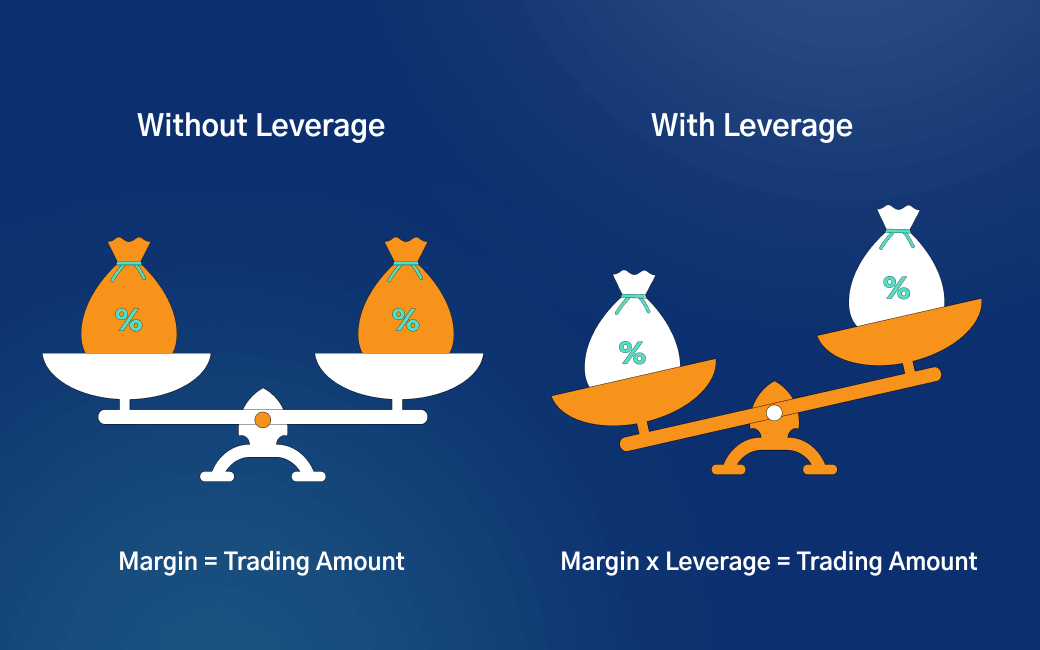

Spot trading can also be accompanied using margin or financial leverage. What does margin, or leverage, mean? For its part, margin enables you to control trading positions way bigger than your capital at hand. In detail, you can go for 500 times more of the amount of your account and open multiple positions across global financial markets.

While this powerful tool is definitely rewarding, it can also have negative implications on your account. Let’s take a look to see how leverage can affect your account.

Leverage can vary between 10:1 and 500:1. These ratios indicate how much you borrow from your broker and the amount you put out on a trade. In other words, on a 100:1 leverage, you should only present 1% of the transaction as a minimum margin requirement.

If you want to go long EUR/USD, you can buy 100,000 EUR with just 1% of it, or 100 EUR. This is what margin trading means. Keep in mind that you control the entire position of 100,000 EUR. On that note, how could this affect your portfolio?

Spot Trading vs Margin Trading

When you use margin, you magnify your potential return. That means your position of 100,000 EUR will give you a pip value of about 9 EUR. So, for a 1 cent move, you could pocket roughly 900 EUR. It’s important to note that this can also turn against you.

If you go long but the EUR/USD falls, a 1 cent move will cost you 900 EUR, or about 9 EUR per pip. There are ways, however, to protect your portfolio from potential losses. We’ll get to them in a second.

Let’s turn to spot trading and see how it compares to margin. Spot trading, in its simplest form, will strip your margin powers. You could still decide to use margin when trading on the spot market. That way you reap the benefits from both sides.

First, you will settle your trades at the time of the exchange. And second, you will be using leverage to enhance your position and get more bang for your buck. Leveraged trading on the spot market is the preferred trading strategy for many market participants.

Increased Buying Power

If there was one thing you needed to know about using margin, it would be this: increased buying power. By using margin on your trades, you are able to open positions reaching far more than your capital. In other words, margin trading is the practice of using borrowed funds from your broker so you could trade positions with bigger sizes.

This is a key trading technique for virtually every retail trader for several reasons. For starters, individual investors are likely to open accounts with relatively small sums. While an institutional investor can trade with billions of dollars, this is not the case for the small trader. In this light, leverage is more than welcome.

Another reason traders use margin is that it enables them to spread across a wide range of markets. On that front, leverage gives you the power to diversify. You can go to currencies and purchase Swiss francs, and you can buy the US 30-stock Dow Jones Industrial Average index. In short, leverage helps you both to concentrate on an asset and to diversify in several markets.

Learn Why People Trade Margin Markets

Trading with margin gives you tremendous opportunities that you wouldn’t have otherwise. In short, these are:

- The opportunity to leverage your trades

- Profit both from long and short positions

- Diversification in a wide selection of markets

- Concentration into a single financial asset

- Going to the market quickly and efficiently

- Being flexible with trading setups

Margin Trading With A Stop Loss

With the above in mind, let’s briefly turn our attention to how you can protect your portfolio from the downside. The main tool you have to use when margin trading is a stop loss. A stop-loss order will cut your losses at a predefined level.

More precisely, you get to choose how much drawdown you can take on any given trade and set this as an exit from your position. What does this mean, exactly? It means that if the price reaches your stop level, your position will close automatically.

For example, if you go long Apple shares at $175 apiece, you can set a stop loss anywhere you like, say $160. If the price slips to $160 a share, your position will be closed. To this end, using stop-loss orders is the best way to protect your account from losses.

If you like to take less risks and less losses, you set a tight stop loss. If you are more focused on long-term horizons, you can open a fairly light position and use a wider stop loss.

Key Differences

Now that we have defined what it means to trade “on the spot”, and on margin, let’s see the main differences.

Spot trading can mean you trade with your funds only. Remember, spot trading can be extended to include margin trading.

Margin, on the other hand, allows you to go both sides of the trade – long and short. Long is when you buy an asset and profit from the upside. And short is when you sell an asset and profit from its decline. In addition, margin trading gives you increased buying power.

Summary

In conclusion, make sure you distinguish between these two trading styles. Before jumping in the market with your hard-earned money, you have to align your goals to a trading strategy. If you prefer less risk, you may look for lower leverage. On the flip side, if your risk appetite is high, you can opt for more leverage.

FAQ

- Why should you transition from spot trading to leveraged trading?

Transitioning from spot trading to leveraged trading will massively enhance your trading experience. It will enable you to open positions much larger than your own capital. If you approach the market carefully and use stop losses, you can reap enormous benefits from leveraged trading. Between the two, leveraged trading is the preferred way of trading for virtually all retail investors.

- What is leverage in spot trading?

Leverage in spot trading gives you increased buying power. It allows you to control positions way bigger than the funds in your account. When you use leverage in trading, you can diversify and invest in more financial assets. You can also concentrate on a single financial asset and get an outsized return if the trade plays out in your favor.