How to Day Trade Crypto For Beginners

Day Trading crypto is a simple concept but can sometimes be confused with other styles of trading. Read our guide to get started.

Introduction

If you are interested in beginning day trading in crypto, you could be onto a winning idea. However, with any financial venture, it is vital to get as much information as possible.

The word “day trader” is often used, and it’s essential to clarify what it entails. Time is of the essence in day trading crypto! Fortunately, you will be walking on a well-trodden path if you are starting now. There are some tried and tested techniques and strategies to help day traders maximize the chances of success in trading crypto. When you feel that you are ready to start day trading crypto, you will need to find yourself a high-quality, reputable online broker.

What is Crypto Day Trading

Day trading can be characterized as buying, selling, or placing derivative trades on crypto-assets, multiple times in the same day to profit from the short-term price changes. Sometimes traders will attempt to maximize their gains by leveraging money from their broker.

The most popular analytic approach used by day traders is “technical analysis,” which involves studying price patterns and chart indicators to find hints of future price movements. It can be highly lucrative when day trading is done correctly, which usually consists in following a careful trading plan, particularly in the fast-paced and volatile cryptocurrency market.

How Does Crypto Day Trading Work

To better understand how day trading crypto works, it may help you walk through the process in three simple steps.

Step 1. Analyze the markets

Before anything is done, you need to look at the markets.

- Chart patterns

Analyze chart patterns and use indicator software to form a technical analysis of different cryptocurrencies. Some examples of chart patterns to look for are the “double top,” “double bottom,” “head and shoulders,” “rounding top and bottom,” “island reversal,” “wedge,” “triangle,” “rectangle,” “cup and handle,” and “flag” patterns.

With a bit of practice, you will spot the patterns by eye. Chart indicators make up the other most considerable portion of technical analyses. There are hundreds of chart indicators out there, but you will be adding a lot of statistical support to your trading decisions by using just three or four indicators.

- Chart indicators

If you are not sure on which chart indicators to start with, ideally, you want to cover the four most prominent characteristics to examine in a price chart. These traits are trend, momentum, volatility, and volume. Therefore, it is a good idea to apply at least one chart indicator to each of these. MACD is useful at determining trends.

The Stochastic Oscillator can show you the price momentum. Bollinger Bands is an excellent volatility indicator. OBV (“On-Balance Indicator”) provides helpful information about the volume of buy and sell orders.

- Fundamental analysis

It is highly advisable that, alongside a technical analysis, you also undertake a fundamental analysis. Fundamental analysis refers to any market news, world events, or competitor movements that may affect the price of the assets you are trading (or are thinking about trading).

Let’s say you want to invest in Cardano (ADA), but you can see that Solana (SOL) is about to release a major update to speed up its network. This may negatively impact Cardano’s price as a rival smart contract platform. Knowledge is a valuable commodity in trading!

Step 2. Buy/sell positions

Once you have completed your analysis, you will be in a much better position to decide which cryptos to buy, sell and hold. The question then becomes, ‘how much should I invest?’. There are several different methodologies you can opt for in determining how and where to allocate your money.

It is always a good idea to diversify your portfolio by purchasing assets from a wide selection of marketplaces. Diversification helps to hedge against any potential losses. You may also want to follow a percentage rule, such as only open trades with a maximum of 2-4% of your total investment funds.

Step 3. Monitor and repeat

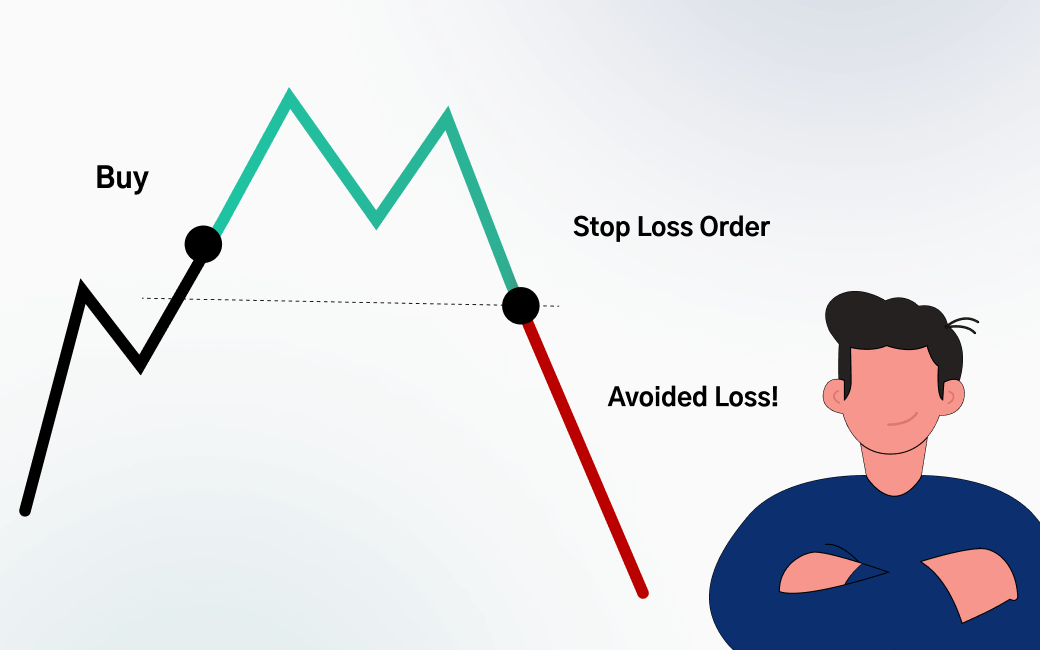

The first two steps are pretty universal in the trading world. Admittedly, a few small steps are omitted, such as creating and managing a trading plan, finding a trading platform, setting stop losses, and taking profits. This third step is where the real difference comes between day traders, scalpers, short-term and long-term investors because the timeframes involved in “monitoring and repeating” trades vary so much.

For a long-term investor, monitoring trades (which involves a running analysis of their price potential) could be fairly minimal compared to short-term, day traders or scalpers. Investing for the long-term means being less concerned about the smaller price movements along the way.

However, for day traders, the hourly price changes of a cryptocurrency are precisely where they intend to make their money. Day traders, therefore, need to actively monitor their progress before buying or selling again throughout the day.

3 Day Trading Crypto Strategies for Beginners

Below are 3 top day trading crypto strategies for beginners to take into consideration:

- Start day trading small

Don’t rush into day trading cryptocurrencies. You will learn a lot about trading through practice, and you don’t want to be making too many expensive mistakes too soon.

- Don’t expect to win every time

When trades don’t go as planned, it’s easy to get disheartened and throw in the towel (or risk more than you had planned to make your money back.) While no one wants to lose money, individual losses are often a stepping stone to greater profits. It is unreasonable to expect yourself to predict every trade’s price movement accurately. What you need to focus on creating is a system that is profitable overall.

- Follow a plan

Sometimes our emotions can serve us well, and our gut feelings can pick the right cryptocurrency to trade at the right time. However, when you are regularly trading, our emotions are unreliable, and we need to make calm, rational, and statistically based decisions instead.

One way to help you do that is to create a carefully constructed trading plan which may include specific rules about the maximum you will allow yourself to invest in any one trade. You should also make short and medium-term plans before purchasing cryptocurrency, such as at what price you will “take profits” and when you will cut your losses (set up a “stop-loss”).

Which is the Best Platform for Day Trading Cryptocurrency?

There are many cryptocurrency exchanges and trading platforms to choose from these days. This makes it easier and more complicated for traders. The competition between brokers can be healthy as features, functionality, and trading costs are continually improving, although some low-quality brokers are also to watch out for. Cryptocurrency trading has also become much more accessible over the years.

Many trading sites will have a selection of cross-market commodities to trade, from stocks and forex to indices and cryptocurrency. We can confidently assert our online brokerage, “TradeOr,” as an excellent option. We have built ourselves a good reputation within the industry; we can offer many services at very competitive prices and much more!

Conclusion

Before embarking on a day trading career, it is essential to understand what this involves and the best way to do it. Learn as much as you can about the theory of day trading, but nothing beats real trading experience. Three big tips are starting trading with small amounts of money (or virtual money), not expecting every trade to make a profit, and always following a trading plan.

There is a lot more to learn, which is why choosing the right trading platform is so important. Don’t put yourself at a disadvantage when you’re starting (or at any point). We strongly believe that our online broker, TradeOr, will be able to meet all your trading needs and surpass all of your expectations. Join so many other happy clients on our crypto day trading platform to discover why. If you have any questions, please do not hesitate to contact our highly responsive and diligent customer support team.

FAQ

- What Is Crypto Day Trading?

Day trading on the cryptocurrency market involves multiple buy and sell orders for one or more cryptocurrencies on the same day. Day traders need to monitor the markets carefully throughout the day and respond fast as prices change. Time is the main factor that sets them apart from other trading types, such as long-term investors.

- What Are Trading Chart Patterns?

Trading chart patterns are shapes on price charts that often signal a direction or duration of future price movements. Double tops and double bottoms are well-known examples. The hallmark "M" shape of a double top forewarns a likely bearish price turn and, conversely, the tell-tale "W" shape of a double bottom signifies increased chances of an imminent upturn in price.

- What Are Chart Indicators?

Chart indicators are software that analyzes different aspects of a commodity's price data. The four areas of a price chart that are examined, and can greatly influence a trader's decision-making, are trend, momentum, volatility, and volume.

- What Is Fundamental Analysis?

Fundamental analysis refers to any world event or market news that may affect the price of the commodity you wish to trade. Highly significant and influential are the movements of competitors.

- Which Is The Best Platform For Day Trading Cryptocurrency?

There are myriad crypto day trading sites to choose from. At TradeOr, we know we can offer an unbeatable service with outstanding features and functionality. Our reputable brokerage is a guaranteed way to get everything you can out of your trading career. We work hard to facilitate everything you will need to focus on your trading. If you have any queries, please contact our friendly customer support at any time!