Introduction

There are many ways of managing risk in trading, and it is highly recommended that you apply at least some of these techniques to your trading strategy. To become profitable, you will need to focus on reducing losses and increasing gains.

Many newbie traders may view losses as a failure and a sign they are not “good enough”. On the other hand, seasoned professionals will have learned that losses can be factored into a successful trading plan. Instead of preparing for profits alone, preparing for losses will help you reduce their impact and know what to do when the green candles turn red.

What is risk management in trading?

Risk management in trading means preparing for losses within your overall trading plan. By recognizing risk is an inextricable part of trading, you can calculate precisely how much you can lose across your trades (and remain profitable overall). Losing some money does not mean you have lost, and it is essential to get out of this “all or nothing” mindset if you want to be profitable month on month. For example, let’s say you have ten trades open, each worth $100. Let’s say one goes down 25% and the rest increase by 2.5% – that would mean you’re down 2.5% overall. That’s not so bad, and if you had a risk management strategy in place, you would have known to end your trade when it was at -22.5% to break even or -20% to remain in profit and so on.

How to manage risk in trading

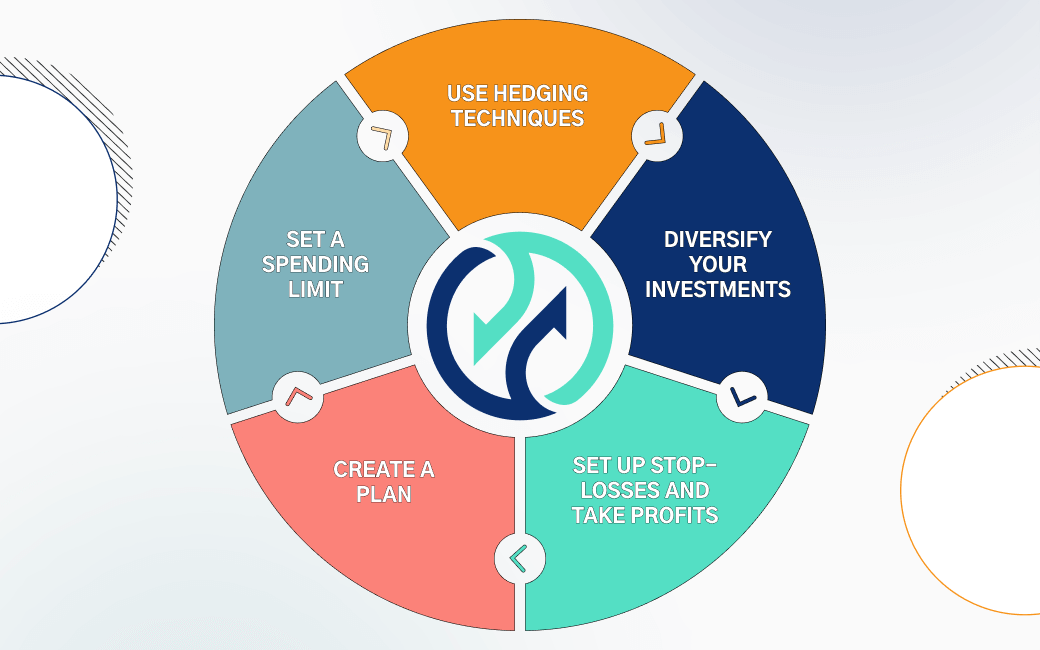

You will need to take some risks, and by learning risk management techniques, you will know exactly how much risk to be taking. Below are five risk management techniques to incorporate into your trading strategy and limit (or avoid) any potential losses. The beginner benefits of risk management are enormous. Learning to prepare for losses and gains will put you in a much stronger position.

Trading does not have to be a “make or break” situation, and learning this early could help you avoid some major upsets. Use some of the following techniques to get more control over your investments, whether they are up or down.

- Use hedging techniques

- Diversify your investments

- Set up stop-losses and take profits

- Create a plan

- Set a spending limit

- Use hedging techniques

Hedging techniques are one of the best-known ways of protecting against losses. The best way to think of them is as a form of insurance and, of course, you will need to pay in one form or another for this peace of mind. Two of the most popular hedging techniques are options and futures contracts.

Options contracts work by offering the trader a “strike price”, a price per share agreed in advance. If the share value dips, the trader can sell at the strike price and avoid more considerable losses.

A futures contract, by contrast, is an agreement between a buyer and seller to purchase and sell shares to one another for a set price in the future. Unlike with options contracts, parties involved in a futures contract are obliged to make the exchange initially agreed.

- Diversify your investments

One of the easiest and most effective ways of managing risk in trading is by diversifying your investments. Diversification means not only investing in multiple assets but across various marketplaces too. Downturns in stock values aren’t just determined by the successes and failures of the individual companies; entire sectors and markets can be simultaneously affected. Let’s say the President of the United States decides to increase the tax rates across the technology sector – the entire technology market could go down. By spreading your investments across different marketplaces, you will better protect yourself from these downward market pressures.

- Set up stop-losses and take profits

Stop losses and take profits, often abbreviated to “SL” and “TP”, are means of creating the price points at which you will sell your shares. A stop-loss will automatically sell your shares when it has dropped to your chosen amount. A take profit works in the same way, but, as the name implies, it is triggered when the price has risen. Setting a stop-loss and take profit are both highly recommended, and they are essential tools in any sensible trading plan. Without setting these mechanisms, you will be undertaking a high level of risk which may leave your overall earnings in the minus.

- Create a plan

Having already alluded to the idea a few times, it is time to state in no uncertain terms that creating and following a trading plan is the cornerstone of managing risk (and becoming profitable). Of course, you might get lucky once or twice, but if you want to get a reliable income from trading, you will need to become systematic and scientific about your approach to investments. You will rarely lose a large sum of money because of a well thought out and risk-managed plan. Frequently newbie traders will forego vast sums of money because of emotional decision-making. You can continue to tweak your trading plan according to what works and what doesn’t, thus creating a virtuous cycle and a highly effective and profitable strategy.

- Set a spending limit

There are two senses in which a spending limit is essential. Firstly, you should only use money from your finances that you can afford to risk (and you don’t need to cover your basic expenses). Secondly, you must decide what percentage of your account you want to risk on each trade. Statistically speaking, investing only 1% of your capital in each trade will allow you to perform 100 trades. Therefore, it will take 100 negative trades to wipe out your entire account, which is statistically very unlikely.

Which is the best platform for managing risk in trading?

Although managing your risk is much more down to your efforts than the trading platform you use, there are a few features to look for. Firstly, if you are interested in undertaking any hedging techniques, you will want to ensure the platform in question can facilitate this. Second, to diversify your investments, you will need access to plenty of assets across many marketplaces. Unfortunately, some platforms have a very narrow range of stocks and shares on offer. Stop losses and take profits are also fundamental functions for a trading platform. Our trading platform, TradeOr, can offer you plenty of risk management features and functionality to give you greater control of your trades.

Conclusion

Managing risk in trading is fundamental to any professional trading strategy. Traders can use several techniques to manage their risk. Hedging techniques are a well-known tool to reduce any potential losses. Diversification of investments has been shown to insure you against market downturns. Stop losses and take profits enable you to sell your assets at the exact price you want. Creating and following a trading plan is the only way to repeat favourable performances time after time. Having a spending limit on your overall trading finances and specific investments will help risk-proof your trading strategy. Our online brokerage, TradeOr, is the perfect place to put your risk management techniques into practice. You can contact a member of our customer support team if you have any questions.

FAQ

- What is risk management in trading?

Risk management in trading refers to various techniques which traders can implement to mitigate losses. Risk management is highly advisable, particularly for traders seeking to be profitable weekly, monthly, and yearly.

- What are risk management techniques?

There are numerous risk management techniques that can be implemented, including hedging techniques, investment diversification, stop-losses and take profits, creating a trading plan, and setting a spending limit.

- What are stop-losses and take profits?

Stop losses and take profits are functions on trading sites that allow you to set the price you would like to sell your asset. The sale of your assets will automatically take place when either your stop-loss or take-profit levels have been reached.

- How much should you invest?

The amount you should invest depends on your financial situation and the strength of chart indicators and other data and information. However, it is not advisable to invest no more than 2-4% of your portfolio in any one asset as a general rule.

- Which is the best risk management trading platform?

We hope you consider our trading platform, TradeOr, in your hunt for the best risk management trading broker. We have many risk-related features (such as stop-losses and hedging options) and a fantastic range of marketplaces, trading software and charting tools, zero trading fees and high leverage options on trades. Please don't hesitate to contact our friendly and responsive customer service team if you have any questions.