Introduction

To the outward eye, traders truly are living the good life. You can work from anywhere, choose your own hours (to suit the market anyway!), and have total autonomy over how to make your fortune. Choose between stocks, cryptocurrency, or buying and selling currency pairs on the foreign exchange (forex).

Success comes with an understanding of the markets, a clear strategy, and the execution of winning trades. Thanks to online trading, anyone can be a day trader! All you need is access to a computer or smartphone, ready funds, and the right tools at your disposal. Here is your quick guide to day trading basics.

What is Trading?

Trading refers to the buying and selling of assets with the hope of making a profit. There are many financial markets in which traders exchange securities. The two biggest exchanges are the stock market and forex. Today, there is also a growing interest in cryptocurrency. Bitcoin and other cryptocurrency tokens (also known as “altcoins”) generate interest from an investment perspective. For an increasing number of online traders, many of the new tokens appeal not for use as a virtual currency or electronic cash. Instead, altcoins such as Ripple or Ethereum represent a potential avenue for profit should they correctly predict the rise or fall of the coin’s value.

Most traders fall under the camp of “day trading.” This refers to short-term strategies where assets are bought and sold within a single day. Trading is not to be confused with investing – while executing trades is a form of fleeting investments, investors tend to buy into assets (often stocks and bonds) with the hope of making a profit over the course of an extended period, perhaps even years. Otherwise known as a “buy-and-hold” strategy, long-term investments generally require a more significant starting capital and will not yield immediate or even moderately quick returns.

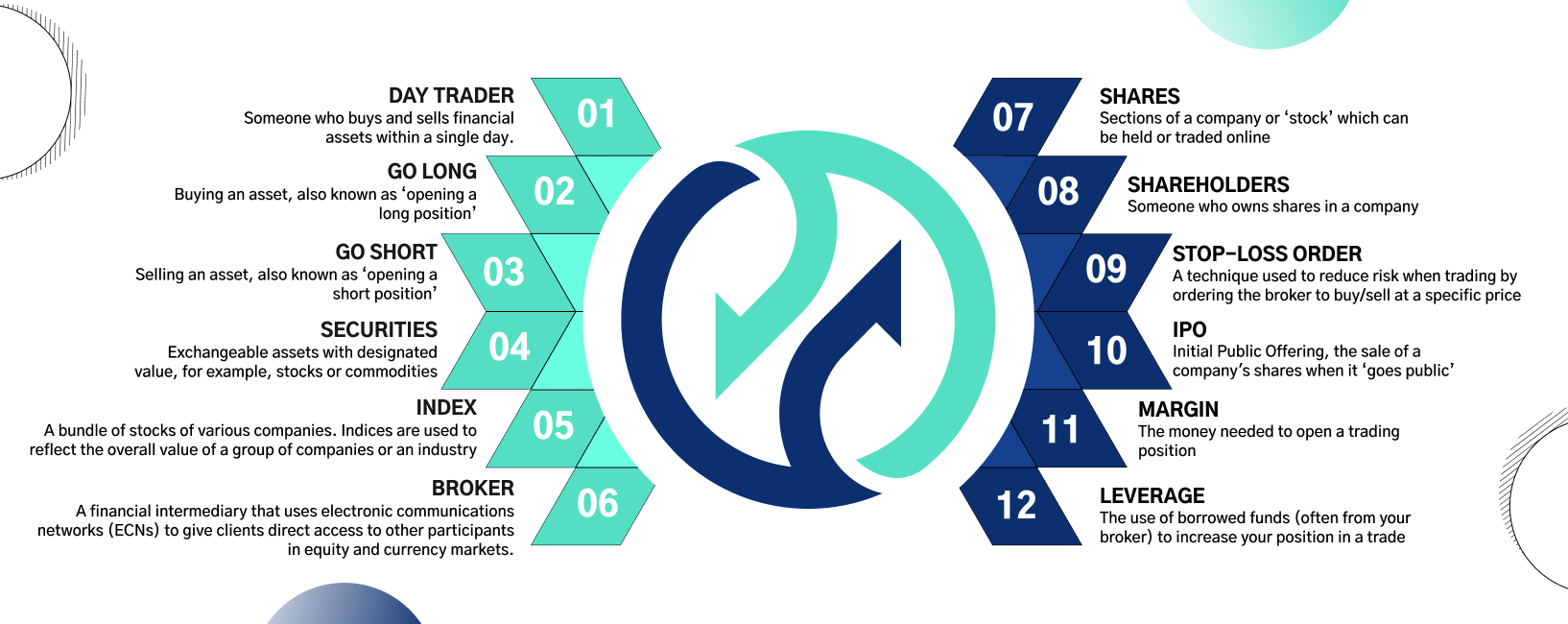

Day Trading Basics Glossary

Online trading can seem daunting at first. Beginner traders may feel like they need to learn a whole new language of industry terms. After navigating the markets and executing your first trades, the terms will become ever more familiar. For now, here are some key words to get you started:

Stock Trading Basics

The stock market is a highly regulated exchange, with set trading hours known as “sessions.” The New York Stock Exchange in Wall Street opens at 9.30 a.m. EST and closes at 4.00 p.m EST. There are an estimated 41,000 companies listed on stock exchanges around the world. Together, these corporations represent a trading volume of over $80 trillion. Stock prices change every day based on market demand versus supply. These market forces and price action are influenced by economic news and press releases relating to the listed corporations.

Basics of Forex Trading

Not all financial markets are alike, and this is quickly explained by comparing stocks to forex. Forex is a portmanteau of the words “foreign” and “exchange.” It refers to the online exchange place of national currencies, which are listed in pairs. The US dollar against the Japanese Yen, for example, would be listed as USD/JPY. Unlike the stock market, you can trade forex 24 hours a day, five days a week. Forex also dwarfs the stock market, being 12 times bigger with a staggering $5 trillion worth of forex transactions taking place a day. Many traders choose forex for short-term strategies because the high volatility of the market makes it especially profitable.

Crypto Trading for Beginners

Like forex, the cryptocurrency market is highly volatile. This means that prices change frequently – and drastically. With the right timing, a cryptocurrency trader can turn these sharp price movements into profit. Cryptocurrency trading is a new and, as such, less regulated market. This can mean both the risks and the potential rewards are greater with crypto trading. Purchasing altcoins can sometimes be a long-winded and perplexing task depending on the token in question. Large investments should be stored offline on hardware known as a “cold” wallet. You can trade cryptocurrencies without needing to buy the underlying coins themselves through brokers that offer derivatives.

Basics of Options Trading

Quite simply, options trading invokes the buying and selling of “options” online. Options are another type of financial asset or security. Options are an example of the derivatives mentioned in the paragraph above. In this case, options are a contract whereby two parties agree to buy or sell an underlying asset at a fixed price. The advantage of options trading is that it offers a flexible and fast-paced way to speculate on the frequent price changes between certain assets.

Day Trading Strategies

Having the right trading strategy is one of the most fundamental pillars of online trading. There is a myriad of strategies to choose from or analytical tools to use in predicting price direction. Strategies vary in complexity, but here are some of the most common methods used in day trading:

- Scalping: scalping is a highly intensive strategy whereby traders make many trades (even hundreds) in a single day. Scalpers try to make an overall profit from the sum of many small gains from the frequent price changes.

- Trading the news: News-based trading uses disclosures (such as economic announcements, employment data releases, and company statements) to inform their trades. News traders seek to profit from timing their transactions in accordance with the release of specific data. Keeping abreast of market news should be an integral part of any trader’s strategy.

- Range trading is a highly active strategy whereby the trader uses two levels or “trading range” to determine their positions. Range trading uses support and resistance levels, in other words, the price “ceiling” and “floor” above or below which there is no activity.

Choose The Right Broker

Once you learn these day trading basics, you will need a platform to begin trading. There are various factors to take into consideration before you settle the trading approach best for you. You must assess your available resources, both the capital you wish to invest and your time to analyze the markets. There are personality types better suited to specific strategies over others; scalping is an intense method that requires decisive individuals to make many trades under pressure. Determine how much you are willing to spend on each transaction and the level of risk with which you are comfortable. Many day traders use leverage to increase their exposure for higher yields, but both profits and losses are magnified. Have clear goals in mind and set risk mitigation techniques like stop-loss orders.

One of the most valuable tools present to a trader is information. Price charts let you analyze the market, and financial media outlets and forums will update you on relevant news. Ideally, you want to find a broker which offers more than just access to the securities

you wish to trade. Compare rates, commissions, and leverage ratios, as well as any technical tools within the platform. Our platform TradeOr offers all the above and more. Our innovative platform lets you trade with derivatives and leverage margins up to 500:1. TradeOr clients have free access to TradingView, a charting software program that enables traders to analyze and personalize price charts.

Understanding day trading basics is the first step to becoming a successful online trader. Alongside a thoroughly researched and well-executed strategy, keeping updated on market news is always beneficial. Even seasoned investors benefit from the trading tips and supportive forums embedded in certain brokerage platforms.

FAQ

- How To Read Stocks As A Beginner?

Understanding stock pricing may not come naturally at first. Stock trading basics can be learnt both from books and from market experience. Getting comfortable with stock charts begins by looking for the price axis and the time axis, then learning to identify trend lines and trading volume. Learning how to read price charts is best done with practice.

- Is Stock Trading Profitable?

All forms of online trading, whether in stocks, crypto, or through derivatives such as options, come with risk and reward. Stock trading can be highly profitable with the right choices. Historically, the stock market returns an average of 10%. The best way for beginner traders to start with stocks is by arming themselves with a well-thought-out strategy and a patient, cool mindset.

- What Is The Best Stock Trading Method For Beginners?

While no single strategy guarantees success when trading stocks, there are a few golden rules to this market. Beginner traders should find a method that works both for their capital and personality. Practice using paper trading or by researching tried and tested methods recommended by fellow traders. Above all, keep your head in the market but leave your emotions out of the trades.