Introduction

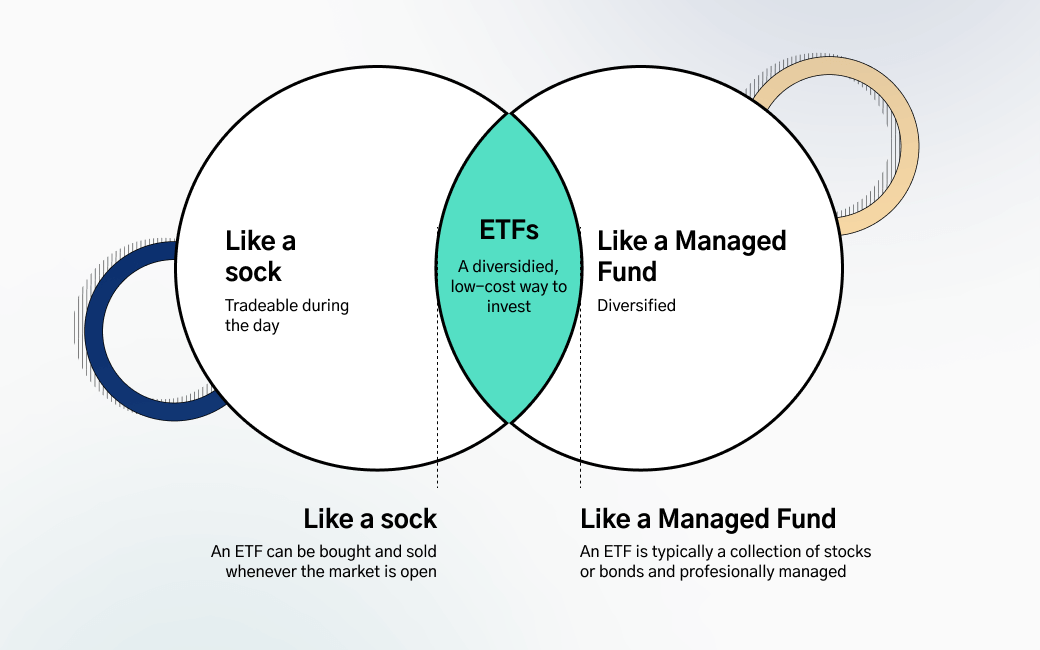

ETF is an acronym of “exchange-traded fund” and is a type of security that tracks a financial index and can be traded on the stock exchange. An ETF is essentially a bundle or “basket” of securities which can be bought and sold online.

An increasingly popular investment choice, ETFs allow traders to speculate on a bunch of companies at once. By buying or trading ETFs, investors can expose their portfolios to a range of shares and diversify their portfolio. Before getting into the fine print of these security bundles, what is an ETF and an ETF fund?

What is an ETF

Exchange-traded funds are sold in a bundle and used to track a specific commodity, index or other financial assets. ETFs are used mainly to track a wide range of securities, often indices. Traders use ETFs to gain exposure to a broad market section, thus diversifying their portfolios.

An exchange-traded fund can be made up of various securities: stocks, bonds, forex or even metals like gold. They are called “exchange-traded” funds because, unlike other investment funds, the shares within an ETF can be bought and sold on a stock exchange. ETFs are also known as “marketable securities”. In other words, they have a set buy or sell price.

ETFs work by tracking the section of the market which they mirror. The exchange-traded fund will own the underlying shares.

For example, an ETF tracking the FTSE100 would have shares in each of the 100 companies making up that index. One of the best known ETFs is “PDR S&P 500 ETF (SPY), which reflects the Standard & Poor’s 500 Index (S&P 500 Index).

ETFs vs Mutual Funds

Because an ETF comprises many different shares, the prices fluctuate throughout the trading day. This differentiates them from mutual funds, which are priced once a day based on the net value of their assets.

Another way ETFs are set apart from mutual funds is because, with the latter, traders would invest a set amount, whereas you can choose how many shares you wish to purchase in an ETF.

Unlike ETFs, investors can buy mutual funds through their broker, but the transaction is not immediate. You can also purchase mutual funds directly from the issuing company, while ETFs can be traded just like stocks. Also, like stocks, ETF prices are in constant flux.

Upsides and Downsides of ETFs

The pros of ETFs may seem obvious: portfolio diversification and minimal effort. There are drawbacks to these funds, however. We will cover both angles here. Firstly, the reason many traders are drawn to ETFs is that:

- They enable exposure to a wide range of securities (stocks, bonds, commodities) often at a low expense;

- Highly liquid: ETFs are easy to trade on an exchange, mainly through an online broker;

- ETFs can provide the fixed-income to your portfolio in a much easier way than by investing in individual bonds.

Not everyone sees the allure of ETFs, and for some traders, this is why:

- ETFs will not provide the same level of return as individual stocks.

- They may be cheaper than buying the same stocks outside of the bundle, but ETFs come with management fees and other related expenses.

- Other options such as mutual funds and index funds can be lower maintenance options for certain investors.

Types of ETFs

Exchange-traded funds are separated into various categories. For example:

Bond ETFs: Bond ETFs are different to bonds in that the latter have a maturity date, unlike the exchange fund. You may have heard of corporate bonds, government bonds or state bonds.

An exchange-traded fund bundle would come at a discounted price from the actual underlying bonds. Investors use bond ETFs for regular and passive income.

Index ETFs: When you hear traders talking about buying and selling ETFs, it is likely to be a type of index fund. Indices themselves cannot be bought and sold, but the ETF gives them marketable value.

Index ETFs are a type of stock exchange-traded fund, whereby a selection of shares will give the investor exposure to an entire section of the market. Stock ETFs are cheaper than mutual funds as they do not necessitate assuming ownership of the relevant shares.

Currency ETFs: This fund will track the value of either an individual currency (foreign or domestic) or a basket of currencies. Currency ETFs can be used to hedge against volatility or inflation in the forex market.

Which Are The Best ETFs?

One ETF could own many underlying shares – up to thousands of stocks across a section of the market. There are US-focused ETFs and global-facing ETFs. Some exchange-traded funds are specific to the financial sector and contain only shares from banks. Here is a selection of the best ETFs for beginner traders:

Vanguard S&P 500 ETF (NYSEMKT:VOO) – This index ETF tracks the stocks of some of the largest companies in the United States. The Vanguard S&P 500 is widely recognized as a benchmark of the US stock market performance.

SPDR S&P 500 ETF: Formerly known as the Standard & Poor’s Depositary Receipts, this ETF tracks the S&P 500 stock market index. It is the biggest ETF worldwide.

First Trust Long/Short Equity ETF: This index fund works for its investors by providing long and short positions in the US stock market.

Schwab U.S. Dividend Equity ETF: This ETF seeks to closely reflect the overall return of the Dow Jones US Dividend 100 index. The Schwab U.S. Dividend Equity ETF tracks the performance of high yielding stocks with consistent dividend schemes.

Vanguard Total International Stock ETF: This popular fund is seen as a benchmark index for tracking the yield and return of developing world companies. The Vanguard Total International Stock ETF holds over 6,000 stocks outside the United States.

How Do I Invest in An ETF?

Once you understand “what is an ETF”, you may want to begin investing in them yourself. Investing in ETFs for beginners is a popular trading choice, thanks to the simplicity and ease of the process.

The process of investing in ETFs boils down to two elements: finding the right trading platform and researching exchange-traded funds. Also, consider implementing these points into your approach:

- Time frame: how many hours can you dedicate to online trading or investing?

- Funds: What is your total available income for investing?

- Risk: what is your risk comfort level, and have you researched risk mitigation techniques like stop-loss orders?

- Strategy: whether you choose a simple buy and sell method or a complicated technical strategy, think it through and stick to your trading plan.

Which Trading Platform Should I Use?

When researching the right brokerage platform, bear diversity in mind. Whether you are a beginner or expert trader, you may want to vary your investment. Perhaps an emerging market interests you (the highly volatile crypto exchange, for example)?

Social interaction with fellow traders may have piqued your curiosity about trying a new strategy or investment opportunity. Find a broker which offers a selection of assets at competitive rates. Ideally, you also want to have the support of a reliable customer service team at hand.

Here at TradeOr, we provide the perfect launchpad for trading forex, futures, commodities, cryptocurrency and more. Our site keeps you updated with the latest financial news, and signing up for our newsletter ensures you never miss a beat.

ETFs are a well-known and simple shortcut to portfolio diversification. By providing instant exposure to a range of financial securities, ETFs also offer protection against market insecurities and inflation. Best of all, with the right broker, ETFs can be bought and sold at the click of a button!

FAQ

- How Does An ETF Make Money?

You can make a profit by trading ETFs simply by buying it at one price, then selling it for a higher price. ETFs will rise in value based on the price activity of the shares held in its portfolio. Market supply and demand will dictate the price of the underlying stock. Another way to make money through ETFs is by investing in funds which pay out dividends.

- How Long Do You Have To Hold An ETF Before Selling?

There is no minimum holding period for ETFs. In other words, you could buy and sell an ETF within a single day without having to wait until the end of the trading session. Certain ETFs (more diversified and passive funds) are better suited to others as long-term investments. Index funds – which make up most ETFs - are considered especially safe investments as the fund will reflect the stability of the overall index.

- Are ETFs Safe To Invest In?

As online investments go, ETFs are widely considered a low-risk choice. While no speculation comes with zero risk, ETFs provide more than just potential profit, but they are a way to diversify your portfolio and protect your assets from market inflation. Nonetheless, there are other costs to bear in mind when investing in ETFs. The sum total of your overall profits will account for these costs (taxation, holding fees etc.)