Introduction

There are many markets to choose from, all with their strengths and weaknesses. An excellent place to start is forex trading for beginners. Forex is one of the most popular marketplaces for traders.

After you learn the basic concepts of forex, the relevant terminology, research the market, create a trading plan, and choose which currency to invest in, you will be ready to begin trading. Whether you decide to invest in forex or prefer another market, you will need to find a reliable online trading platform. The broker you choose can make or break not just your trading experience but your chances of turning a profit as well.

What is Forex Trading?

“Forex” is a portmanteau of the words “foreign” and “exchange.” The foreign exchange can be used to buy bonds, invested in by individuals, companies, and more. The most popular utilization of the forex market is through investor trading, however. Forex tracks the exchange rate (the difference in value) between currencies, and traders can profit from the price movements between them. Each major currency is pitted against the other in this way, and they are referred to as “currency pairs.” The format of forex trading on currency pairs differentiates itself from other markets. When you invest in a currency, you are not just betting on one commodity to increase (a “long bet”); you are simultaneously betting against another to go down (a “short bet”) and vice versa.

There are many advantages to trading in the forex market. Firstly, the market is open for trading worldwide 24 hours a day, five days a week. You can also withdraw your investment quickly and convert it into your local currency. The ability to move swiftly and retrieve your funds is called “high liquidity,” and it is an excellent thing in the finance world. Another big plus about trading on the forex market is you can bet on and against a currency (as outlined above) which is not possible in all marketplaces. Forex is popular amongst “day traders” and “scalpers” (people making multiple trades in the same day) because the transaction fees are low. Another compelling reason to invest in currencies is you can use leverage. The leverage rates will vary from broker to broker, so it is worth shopping around!

How Do You Trade Forex?

As mentioned above, forex trades are centred around the price differences between currencies, and there are plenty of ways to make your investment. Trading avenues available to you include currency options, currency futures, spread betting, spot FX, retail forex, CFDs (contracts for difference), ETFs (exchange-traded funds), and more. Different trading options allow you more freedom to trade in the way you want. Derivative bets, such as options and futures contracts, provide you with a level of insurance (a “hedge”) for your investments. On the other hand, CFDs enable you to bypass the exchange altogether with a separate agreement between you and your broker.

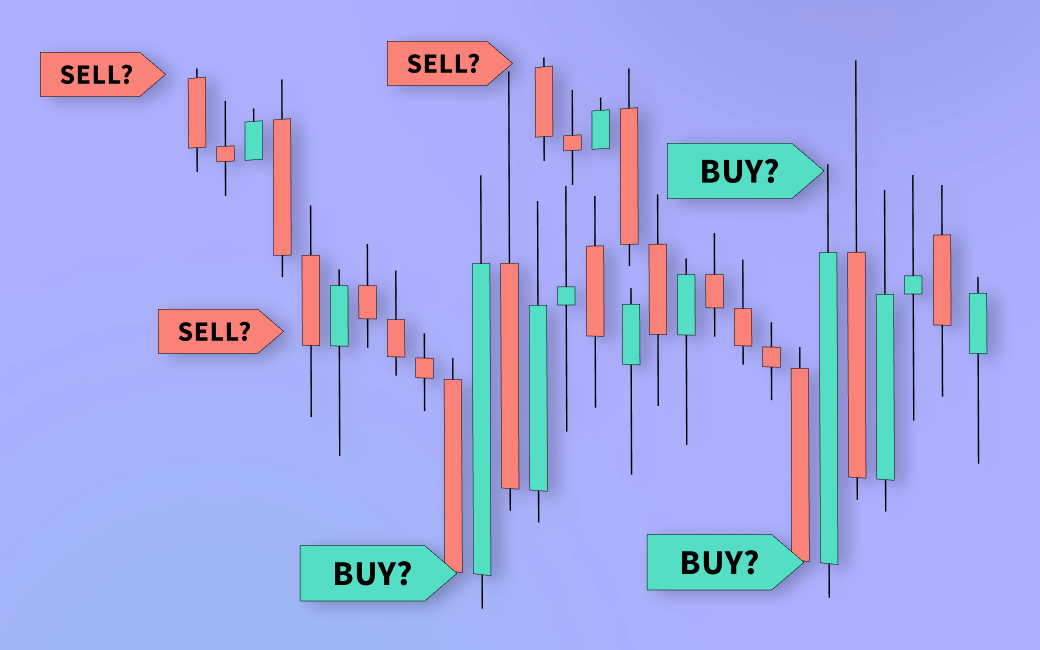

Before exploring the many ways you can trade on the forex market, it may help to walk you through the steps to making the most basic kind of forex trade: the long bet. After setting up an account with an online broker and adding some funds, navigate to the platform’s forex market page. Here, you should be able to view the exchange rates between currency pairs and the ask and bid prices.

The asking price is the amount you will need to pay for a particular currency (relative to the other currency in its pairs). Let’s say the US dollar is $1 for every €1.70 (Euros). $1 is the asking price, whereas the bid price is the amount you can sell it for, $0.988, for example. The bid price will always be a bit lower than the ask price, and the difference between them is called the “spread price.” It is important to factor the spread price into your accounting, or it may silently eat up your profits.

When you feel confident the time is right to set up a long trade in a currency, you can purchase it at the stated ask price. You can hold on to this investment for as little or as long as you like. It is always worth remembering to set up a “stop-loss” and “take profit,” which are orders to sell your position when a specific price point is reached below or above the price of your initial investment. This is one example of a trading tip that will help you avoid some of the pitfalls of forex investing for beginners.

Forex Trading For Beginners: Trading Tips

1.Use technical indicators

One of the most popular trading tools is “chart indicators.” Indicators are used to analyze and interpret price data to give traders an idea of a currency’s future trajectory. There are four main aspects of a currency that chart indicators can help elucidate: trend, momentum, volatility, and volume. By learning about the nature of a currency, you can form an evidence-based trading plan. Some of the best-known forex chart indicators are Bollinger Bands, Moving Average Convergence Divergence (MACD), Simple Moving Average (SMA), Stochastics, and more.

2. Apply fundamental indicators

“Fundamental indicators” refers to all market and world news relevant to a particular currency. If you are investing in the US dollar versus the Japanese Yen, it would be advantageous to follow financial information in Japan. A dip in the Japanese economy could translate to a profit if you have invested in the US dollar.

3. Create a trading strategy

Almost every long-term forex investor will tell you to create and follow a trading plan. The trading plan itself isn’t something static, although you can copy a lot of approaches and ideas from other traders. You should be flexible with your plan and adapt it according to profits and losses, thereby creating a “virtuous cycle” which will keep you profitable month after month. Sticking to your plan will also help you stop making emotional trading decisions. Over time, a strategic and fact-based approach is more likely to serve you best. Research the best forex trading strategies for beginners and find the best approach which suits you – taking into account your available time, collateral, and trading style.

4. Set a stop-loss and take profit

A golden rule of forex trading is to set stop-losses and take profits. As part of your trading plan, you should work out how much you can afford to lose on each investment to remain profitable overall. Without a stop-loss, you are unlikely to effectively manage your losses which most successful, professional traders will view as a necessary part of forex investing. Equally, setting a considered amount to set as a take profit will help you consolidate your gains.

5. Choose a high quality, reputable broker

Don’t just choose the first broker which pops up on a Google search. Make sure you thoroughly research the broker you are going to use. Aside from offering trades on forex, you will want to ensure they have all the features and functionality you are looking for. Check out their list of trading fees in advance (sometimes these can be hidden in the small print), and test out their customer support team, as this will be your first port of call if anything goes wrong. Review websites can give a good indication of a trading platform’s reputation, and if the broker offers virtual trading, then you can try them out for free!

Where Is The Best Place For Forex Trading For Beginners?

While there are numerous forex trading platforms to choose from, separating the wheat from the chaff can be difficult. We can wholeheartedly recommend our trading site, TradeOr, however. We have a long-range of currency pairs to choose from and all the other major marketplaces (stocks, commodities, cryptocurrencies, etc.). This is very useful if you want to diversify your portfolio. Our site offers many features, such as price charts and indicators, to make your trading experience as straightforward as possible. We offer high leverage rates on CFDs (“contracts for difference”) and low trading costs. If you have any questions or difficulties, you can speak to one of our friendly support team available 24/7!

It is hard to beat the forex market when it comes to value for trading money. Other markets, such as the stock market, are more heavily regulated. Without a centralized exchange (such as Nasdaq) controlling prices, traders can negotiate between themselves, and greater variety will occur. Also, with thousands of stocks to choose from, beginner traders may understandably be overwhelmed. In contrast, forex trading tends to revolve around the same major currency pairs. Whether you want to dip a toe in the trading waters or “go big” and begin wheeling and dealing some nifty trades, forex is a brilliant place to start.

FAQ

- What is forex?

The long-form of forex is "foreign exchange." In other words, the marketplace for the exchange of foreign currency pairs. The strongest economies tend to issue the most-traded forex pairs, including the US dollar (USD) Euro, and British pound (GBP).

- What is the difference between the forex market and stock market?

The stock market refers to the comprehensive collection of stock exchanges worldwide. "Stock" means the shares of publicly listed companies. The stock market is highly regulated and often has a physical location—for example, the New York Stock Exchange (NYSE) on Wall Street. On the other hand, Forex is a digital marketplace where brokers, traders, and other types of investors meet online to buy and sell currency pairs.

- How can a beginner benefit from forex trading?

"Forex trading for beginners" is a much search for term on Google, and for good reason! Many beginner traders choose forex as the first asset to buy. The major currency pairs will be familiar, and most of us will have made a simple currency exchange when traveling abroad. Trading forex pairs is an exciting and potentially lucrative avenue into online trading. Make sure you have a trading plan at hand and find a feature-rich broker like TradeOr to help you learn the ropes!