Introduction

Learning an effective forex trading strategy will increase your chances of pulling a profit. ‘If you fail to prepare, prepare to fail,’ as Benjamin Franklin once said.

You can get lucky, but if you are relying on luck alone, you may as well go to a casino. If you analyze the portfolios of the most successful forex traders (over the long term), you will see they are all using a forex strategy. While the strategy specifics vary, there are some golden rules which most professional traders will follow. Finding the right brokerage is a much undervalued but crucial aspect of any forex strategy.

What is Forex Trading?

“Forex” is a portmanteau of the words “foreign” and “exchange,” which refer to the buying and selling of currency. Currencies are partnered up to create (“currency pairs”). Traders can trade on the price gains and losses of one currency relative to each other. Let’s take a famous currency pair as an example.

If 1 US dollar is worth 0.7440 GBP on Monday and 0.7455 GBP by Friday, then to expect the US dollar to appreciate against the Great British Pound (“going long”) would have gained you 15 pips (the smallest unit of value “percentage in point”) multiplied by your position size. If you had hypothetically invested $10,000 on USD, then you would have gained $15 from this trade (minus any fees your platform may have).

Forex trading can seem complex from the outside, but it all starts to make sense when you have got your head around some of the words and terminologies peculiar to forex.

What is An Effective Forex Trading Strategy?

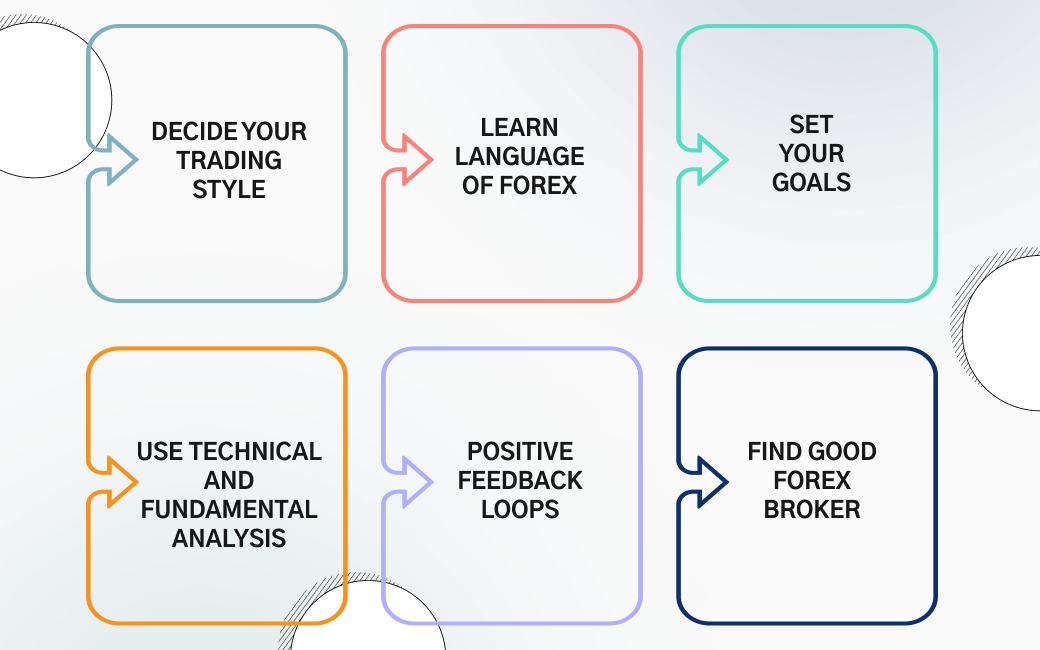

To fine-tune your forex trading strategy can take years of practice and learning, but you can give yourself a head start by learning some of the fundamentals of forex trading. The following is not a complete list, and it cannot guarantee success, but hopefully, it will help you avoid some of the famous pitfalls of the trading world.

- Decide your trading style

In the process of learning about forex and various trading techniques, you will undoubtedly begin forming an idea about what sort of trading style will suit you. There are two main types of traders (which can then be further subdivided). Short-term traders perform trades throughout the day, perhaps even multiple times per hour.

You will need a lot of time and energy to profit from the small price fluctuations in currency pairs. At the other end of the spectrum are long-term investors. Trading long-term means you will leave your trades to ride out the more minor dips and highs to profit from the price difference at a larger scale. Learning which one of these two (broad) camps you fall into will help you decide everything from your trading strategy to which online trading platform you will use.

- Learn the language of forex

The more words and phrases you can learn, specific to forex, the more you will understand the market itself (how it works etc.) and be able to comprehend articles related to it. Here is a short vocabulary list to get started with: “lot” (also “standard lot”, “mini lot”, “micro lot”), “QE” (“quantitative easing”, “ask/offer”, “order”, “momentum”, “MA” (“moving average”), “market price”, “market order”, “margin”, “liquidity”, “indicators”, “GDP” (“gross domestic product”), “fundamental analysis”, “floating leverage”, “Fibonacci retracements”, “CFD” (“contracts for difference”), “bid”, “Federal Reserve”, and “ECB” (“European Central Bank”).

- Set your goals

Without a trading plan, you will continually be questioning, ‘Should I get out now? Or buy more?’. Not only is this an exhausting way of operating, but it is also very ineffective. You can’t expect to make the right call every time or read all the market and chart signals perfectly.

Instead, it would help if you decided before you make a trade how much you want to profit from it and at what point you will get out. These are known as ‘entry points’ and ‘exit points.’ The temptation is to keep raising your exit points as the price rises but sticking to your plan will help keep your portfolio on a strategic path and curb excessive greed and fear. It’s also a good idea to set your overall trading targets.

- Use technical and fundamental analysis

If you do not have justifications behind your trades, you are simply gambling your money. There’s a 50/50 chance a currency will go up or down and, after paying the spread bets and other trading platform fees, after enough time, you are destined to lose your money. By using either technical or fundamental analysis, however, you can push the odds in your favor.

Technical indicators help you to analyze the price movement of currency pairs on charts. The Bollinger Band and the Stochastic indicator are two famous examples of these. Fundamental analysis refers to market news, world events, and social indicators (where the crowds are leaning). It is highly recommended you apply at least one of these types of analysis to your trading.

- Positive feedback loops

When your trading strategies are successful, repeat them. These are called positive feedback loops, and this is how experienced traders can make money time after time on the forex market. Equally, if some techniques are not working, let go of them. Never become set in your ways, even with successful trading patterns. You need to be able to adapt to the changing markets. The perfect formula now will not be the same as the ideal formula in five years.

- Find a good forex broker

Lastly, but arguably most importantly, it is worth spending time finding the right forex broker for you. There are many factors to consider, and it will be easier to decide when you have worked out your trading style (long-term or short-term investing). A brokerage should first and foremost have a good reputation. With so many trading platforms these days, it can be challenging to separate the wheat from the chaff (and the downright dishonest).

Make sure they have a long list of currency pairs available on the forex market, as well as any stocks, commodities, and other assets you may be interested in. Look for a site with low trading, deposit, and withdrawal fees (with quick deposit and withdrawal times). Low fees are particularly desirable if you are making regular trades. It should also have a helpful and responsive support team. If not, you should take it as a red flag!

Which is The Best Online Forex Broker?

There are significant subjective elements to deciding which is the best forex broker. Nevertheless, our trading platform, “TradeOr,” can certainly offer everything a beginner or experienced trader will need. Fortunately, TradeOr caters to both long-term and short-term investors. With low trading fees and zero commissions, it’s an ideal platform for frequent forex trading. It is a reputable brokerage with a long list of marketplaces and assets to choose from. Our deposit and withdrawal times are fast, and our support team is on hand to help 24/7. You will have access to several chart indicator tools and even a demo account, through which you practice your trading strategy and test out our platform for free!

Conclusion

A forex trading strategy can take years to perfect, and it should always be malleable so it can keep up to date with the ever-changing markets. Nevertheless, by deciding your trading style, learning the language of forex, setting your goals, using technical and fundamental analysis, creating positive feedback loops, and finding a good forex broker, you will be off to a great start.

The simplest of these steps, choosing your forex trading platform, is perhaps the most crucial. Fortunately, an easy solution to this is our online forex brokerage, TradeOr. We can cater to all trading types, and our low trading fees, along with a host of features and functionality, make it difficult to beat. You can test it out yourself, without spending a cent, by trading with virtual money on a demo account!

FAQ

- Is It Easy To Make Money On The Forex Market?

If you are lucky, it can be straightforward to make money from forex. However, if you want to make lots of trades, then skill becomes a bigger factor than luck. Fortunately, however, with careful research, a clear trading plan, and a good trading platform, you can regularly pull a profit on the forex market.

- What Is Forex Trading?

"Forex" is a portmanteau of the words "foreign" and "exchange," which refers to the buying and selling of currency. Currencies are partnered up to create ("currency pairs"). Traders can bet on the price gains and losses of one currency relative to each other. Let's take a famous currency pair as an example.

If 1 US dollar is worth 0.7440 GBP on Monday and 0.7455 GBP by Friday, then betting on the US dollar to go up ("long bet") would have gained you 15 pips (the smallest unit of value "points in percentage") multiplied by your position size. If you had hypothetically invested $10,000 in USD, then you would have gained $15 from this bet (minus any fees your platform may have). Forex trading can seem complex from the outside, but it all starts to make sense when you have got your head around some of the words and terminologies peculiar to forex.

- What Is An Effective Forex Trading Strategy?

To fine-tune, your forex trading strategy can take years of practice and learning, but you can give yourself a head start by learning some of the fundamentals of forex trading. The following is not a complete list, and it cannot guarantee success, but hopefully, it will help you avoid some of the famous pitfalls of the trading world. 1. Decide your trading style. 2. Learn the forex language. 3. Set your goals. 4. Use technical and fundamental analysis. 5. Positive feedback loops. 6. Find a good forex broker (such as our trading platform, TradeOr).

- Can You Place Derivative Bets On The Forex Market?

Derivative bets can be accepted on the forex market, but this may vary from broker to broker. Our online trading platform, TradeOr, offers derivative bets on forex, including hedging techniques, CFDs ("contracts for difference") with high rates of leverage, short bets, and more.

- What Is The Best Online Forex Broker?

There is a large subjective element to deciding which is the best forex broker. Nevertheless, our trading platform, "TradeOr," can certainly offer everything a beginner or experienced trader will need. Fortunately, TradeOr caters to both long-term and short-term investors. With low trading fees and zero commissions, it's an ideal platform for frequent forex trading. It is a reputable brokerage with a long list of marketplaces and assets to choose from. Our deposit and withdrawal times are fast, and our support team is on hand to help 24/7. You will have access to several chart indicator tools and even a demo account, through which you practice your trading and test out our platform for free!