Portfolio Diversification: Where to Invest?

They say it’s a wise thing to not put all your eggs in one basket. So when it comes to the financial markets, we definitely have to agree. That’s why portfolio diversification is a crucial habit that all traders should cultivate.

Our blog today tackles precisely this. Read on for all the details.

What is Portfolio Diversification?

The element of risk permeates the financial services sector. Thus it is a daily reality that traders must balance out with the potential gains of every trade that they make. As such, finding the optimal point between a well-thought-out risk and a rash decision requires calibration and experience. However, one thing is certain, your capital is your most important resource and should be utilized judiciously.

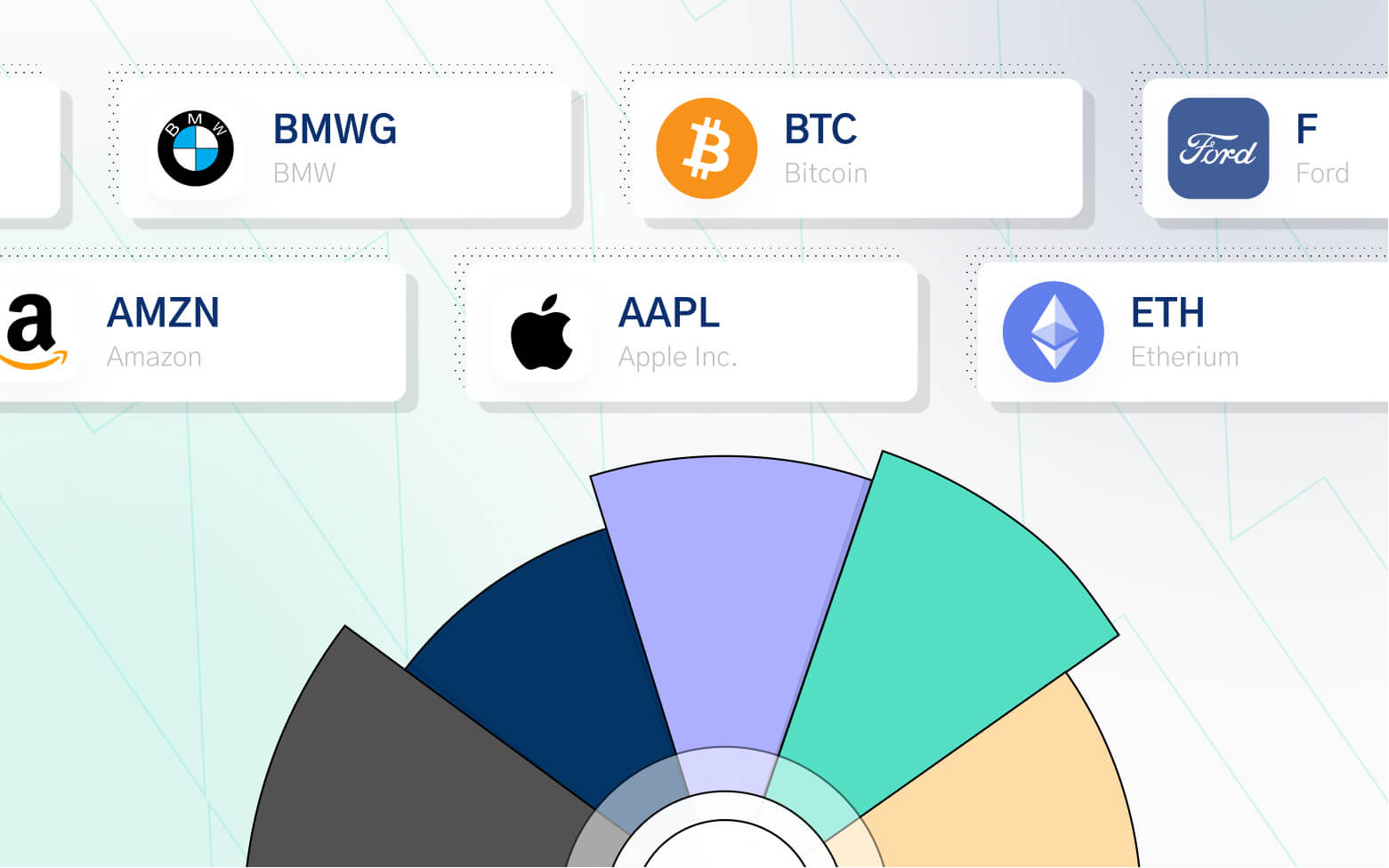

Portfolio diversification is the process through which a trader chooses how to allocate capital among different investment options. Therefore, a balanced and distributed approach ensures that the risk of capital loss is minimized or reduced. Typically, a diversified portfolio may include a proportionate mix of stocks from various countries, sectors, and companies. Consequently, investment in different markets (for instance digital assets, precious metals, and currency pairs) ensures that your capital is not as susceptible to a particular event or trend within one market.

It is often too easy to get swept away in the excitement and our (at times subconscious) fear of missing out may lead us to act irrationally and invest all our capital in one particular asset or market. This may lead to a fortunate scenario where this goes well and a substantial gain is made. But this is very risky behavior that can also lead to big losses. Conversely, investing in a variety of stable options means that returns are likely to take longer to accumulate but will also be sustainable in the long term.

Which Markets Should You Consider?

A good principle to keep in mind within this context is that a broad base provides more stability. These are some of the options that can help you to create a solid foundation that can withstand the unexpected:

Stocks

Stocks constitute a great investment option since they give you the possibility to invest across multiple industries and include both well-established and promising companies.

Metals

Gold, in particular, has long held the covetable ‘safe haven’ status due to its stability and reliability.

Index Funds

Indices are characterized by lower costs, enable you to diversify your investment and provide adequate returns.

Cryptocurrencies

The cryptocurrency market may have been regarded as the enfant terrible of the trading world but the concept of cryptocurrencies is increasingly being embraced by users and institutional stakeholders. Investing reasonably in high-performing digital currencies is likely to benefit your portfolio.

Accordingly, just like everything else in life, balance is the key to fruitful long-term investments. Thus, creating and maintaining a diversified portfolio is the optimal way in which to safeguard your capital and create the necessary framework for sustainable growth.

With everything from stocks, cryptocurrencies, ETFs, and Indices; TradeOr enables you to invest and trade in the markets that suit your goals and portfolio needs. Sign up today to create the portfolio that you seek.