How Does

Bitcoin Work?

Before you try to understand how Bitcoin works let’s first break down how other forms of exchange works.

So, you are sitting in your favourite coffee shop and your friend gives you €10. In this situation the cash is placed directly into your hand, you now have €10, and your friend doesn’t. Simple right?

Your friend gave something of value, and you received it. No need for an intermediary to help make the transfer. It works similarly with Bitcoin. The difference with Bitcoin transactions is they operate digitally. Now you might be thinking, how do I know that the €10 was not sent somewhere else beforehand? Or how can I be sure that copies aren’t made, and funds were stolen?

In layman’s terms, each Bitcoin is in essence computer files that are stored in a digital wallet that is accessible through your desktop or mobile device. Each transaction is tracked in a ledger (think of it as an accounting book) that everyone has access to. All transactions that have occurred over time are recorded in this ledger. Thus, people cannot cheat it. The ledger is not controlled by any one person, the rules are already predefined. Furthermore, the code on which it is built is open source meaning anyone can participate in the network. It is there for people to maintain, secure, and improve.

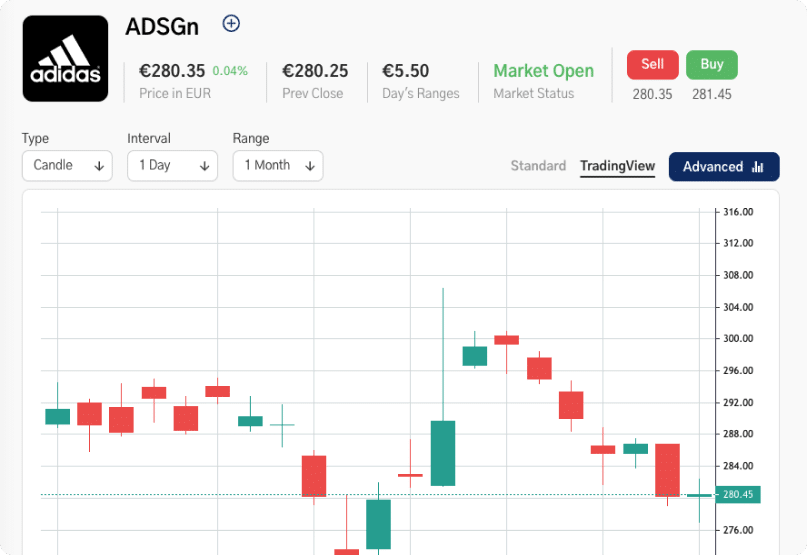

Within the Blockchain, the exchange of the digital currency is exactly like the physical exchange of €10. In other words, it behaves like a physical transfer, but it is still digital.