Introduction

To become a successful forex trader, you will need to start living the forex traders lifestyle. This doesn’t mean you will need to wake up at the same time or eat the same food as them, but specific behavior patterns are well worth emulating.

Imagine you are about to enter a maze and, on either side of the entrance, are former winning maze contestants. You are allowed to ask them for their advice. Do you ignore them and go it alone? Why deny yourself the possibility of getting some free help from someone who has done it before? It is the same with trading, but unfortunately, most traders go it alone, or worse, they listen to the biased babblings on social media sites and internet forums. To make it into the winner’s circle, you need to have a wall street trader´s lifestyle!

What Is A Forex Trader's Lifestyle?

The lifestyle of a trader on the forex market varies hugely from person to person. There are several characteristics of both profitable and losing trader mentalities. Strategies which tend to fail are overly emotional, impatient, and are driven by greed and fear. Unfortunately, because so many other traders are this way inclined, whole swathes of people end up buying at the top (when a currency is doing well) and selling at the bottom (when it seems too “risky”).

If trading is just about making a quick buck for you, then the chances are you will lose money. Successful forex traders love trading for the sake of trading (of course, money is important too). They create a plan based on risk versus reward and patiently repeat their winning methodology. Afterward, they analyze their performance like a chess player would and, most importantly, never give up. If you are serious about trading, you will need to dig deeper than a general definition.

How Can You Live The Lifestyle of A Trader?

There are some well-known clichés about how to live a rich forex traders lifestyle that may have lost some of their impact over the years. It is essential to use a statistical approach to trading, leave your emotions at the door, and only risk what you are willing to lose – but you already knew that, right? With about 90% of forex traders losing money, this generic advice is clearly not working. Let’s dig a little deeper into what makes a successful forex trader’s lifestyle.

- Perception of losses

When many newbie traders start, their eyes are firmly set on the +/- percentage column for each currency pair position they have opened. When the profits roll in, they tell themselves they are good at trading, but when there’s a dip in the market, suddenly, the whole thing starts to seem like a bad idea. To tap into the mindset of a seasoned trader, however, you will need to start looking at your losses differently. Losses should be seen as an opportunity to learn and re-evaluate your trading plan. If a trade is going badly, it doesn’t mean you are a terrible trader, just that you need to adjust your strategy. Don’t forget to keep track of what is going well so you can repeat them!

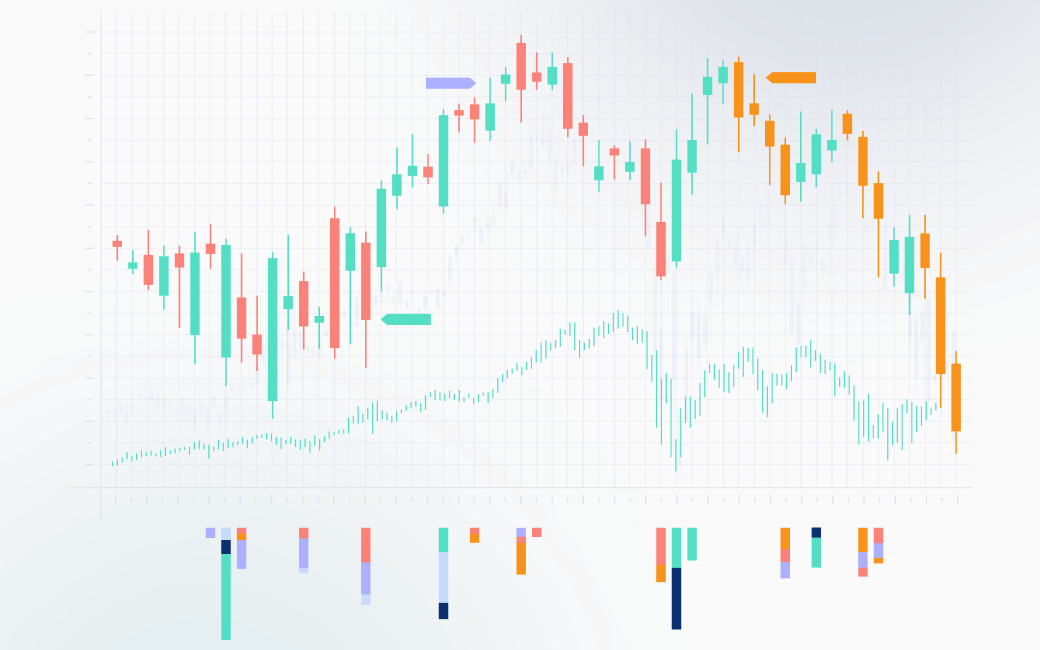

- Price action

“Price action” refers to the traits of an asset that can be inferred through its price data. These characteristics include trend, volatility, momentum, and volume. You can elicit information about each by recognizing chart patterns (such as double tops and double bottoms) or by using chart indicator software (for example, Bollinger Bands, Stochastics, MACD, and more). Learning to read the charts is one of the most valuable tools for a trader. When you have formed a future price prediction, it is good to set “take profits” and “stop-losses.” Setting limits will help you stick to your plan and avoid getting sucked into the cycle of greed and fear.

- Don’t force a win

It may sound bizarre, but the best traders don’t push too hard to make their profits. Yes, they will spend a lot of time researching their various positions. However, if the pair does not have the specific signals they are looking for, they will not be afraid of delaying or abandoning the idea. As they are in no rush, time is on their side, and they can wait for the right moment to purchase whichever currency pair (or another commodity) they may be interested in. Patience also applies to when a trade is going badly. Blindly pumping money in, in the hope of recovering your losses is a big no-no if you want to operate like a professional. Chalk it up to experience, adjust your trading plan and wait for the next opportunity to come along!

- Think like a poker player

When a professional poker player is dealt a pair of aces, they won’t just thank their lucky stars and wonder when it will happen again. They would know the odds of being dealt two aces (or any specific pair) are 220-1 or 0.5%. Equally, when they must make difficult betting decisions later down the line, they will know their win probability and risk percentages. There is a significant psychological element in poker, but knowing these percentages is one of the essential dividing factors between themselves and amateur poker players. It is a similar story in trading. Ensure you know exactly how much you risk for each trade and what you hope to gain. Get stuck into the numbers, not the narrative!

- Forget the win/lose percentages

Suppose you’ve seen traders advertise themselves on trading platforms for you to copy their trades (a feature that is not possible with every online broker). In that case, you will most likely have seen them advertise their month-by-month or annual percentage gains. While this may appear impressive, it is possible to have lost money overall but have accumulated a high percentage of winning positions. As a simple example, imagine you put 10$ into a currency pair every month and gained 10% each time, apart from one month where you traded 1000$ and lost 10%. Overall, your win percentage would be very high for the year, but you would have made a loss. It’s about how much you win versus how much you lose that matters!

- Love trading

Of all the ways to lead a forex trader’s lifestyle (and there are many more), loving trading for the sake of trading has got to be the biggest. If you love trading, then most of the other qualities of a professional trader will come naturally. You won’t get caught in the cycle of greed and fear. You won’t be overly emotional with your trading decisions or use more money than you can afford. When one of your positions enters the red, you won’t just give up hope. You’ll be much less likely to give up, which means you will always be making progress. You will think like poker and a statistician. You will be happy to devote a lot of your time to trading and analyzing the markets, as well as learning trading techniques. Making money is absolutely the goal, but it can easily blind you from the best means of doing it, and a love of trading will help remedy that.

Conclusion

If you want to trade on the forex market like a pro, it will be helpful to learn the forex traders lifestyle. By imitating the successful habits of expert forex traders, you will maximize your chances of making it into the 5-10% of long-term profitability. Amongst a host of trading habits and techniques, it will help you readjust your perception of losses. You will also want to include price action analysis on your trades and think like a poker player regarding win probability and risk percentages. Forget about the win and lose percentages and focus on the amount you have won or lost. Finally, have a healthy dose of love and passion for trading, as this will help your trading in many ways. Ironically, being solely motivated by money will most likely lead you to make bad decisions.

FAQ

- What Is Forex?

Forex is a portmanteau of "foreign" and "exchange. Traders generate profit by taking advantage of the fluctuations that are generated on "currency pairs," such as the US Dollar versus the British Pound.

- What Is A Forex Traders Lifestyle?

A "forex traders lifestyle" refers to the daily trading habits of a forex trader. Newbie traders may wish to emulate these habits to achieve similar results. It is highly recommended to do this and avoid learning every single lesson the hard way!

- What Is Price Action?

Price action is simply the movement of an asset's price over time and the characteristics inferred from it. By studying chart patterns and applying chart indicator software, traders can elicit much information regarding a particular asset's trend, momentum, volatility, volume (and more).

- What Is The Lifestyle Of A Trader?

Several qualities make up a successful trader. Among others, these include having a healthy perception of losses, analyzing price action, choosing not to force a win, thinking like a poker player, and focusing on the real figures and not winning or losing percentages. Finally, a love for trading itself can go a long way to right many of the mistakes made by newbie traders.

- Which Is The Best Platform For Trading Forex?

There are myriad forex trading sites to choose from. At TradeOr, we know we can offer an unbeatable forex service with outstanding features and functionality (for other marketplaces too). Our reputable brokerage is a guaranteed way to get everything you can out of your trading career. We work hard to facilitate everything you need to focus on your trading. If you have any questions, don't hesitate to get in touch with our friendly customer support at any time!