Key Takeaways:

- Short-selling bitcoin is possible even with leverage but has key risks involved

- Technical and fundamental analysis could help you decide if you want to short BTC

Bitcoin and Its Volatile History

Bitcoin has been around for a few years now, 12 to be precise. During that time, the cryptocurrency has experienced tremendous growth, but not without major pullbacks and extreme volatility. To this end, many have tried to short the original coin, with mixed results in the end.

This guide aims to shed light on what it means to short bitcoin. We also cover the market environment that would be most convenient for opening a short position in bitcoin. In addition, you will learn about some short-selling bitcoin strategies that you can use in your own trading endeavors.

Bitcoin is the most-known and widely-traded cryptocurrency. With a market cap gravitating towards $820 billion, the token currently boasts a price tag of about $45,000 apiece.

With this in mind, it has certainly not been a smooth ride for the coin along the years. Throughout its history, bitcoin has endured more than 15 selloffs of more than 30%. Further, six drawdowns have resulted in a fall of 50% or more. Another three have wiped out over 80% of the token’s valuation.

How to Short Bitcoin

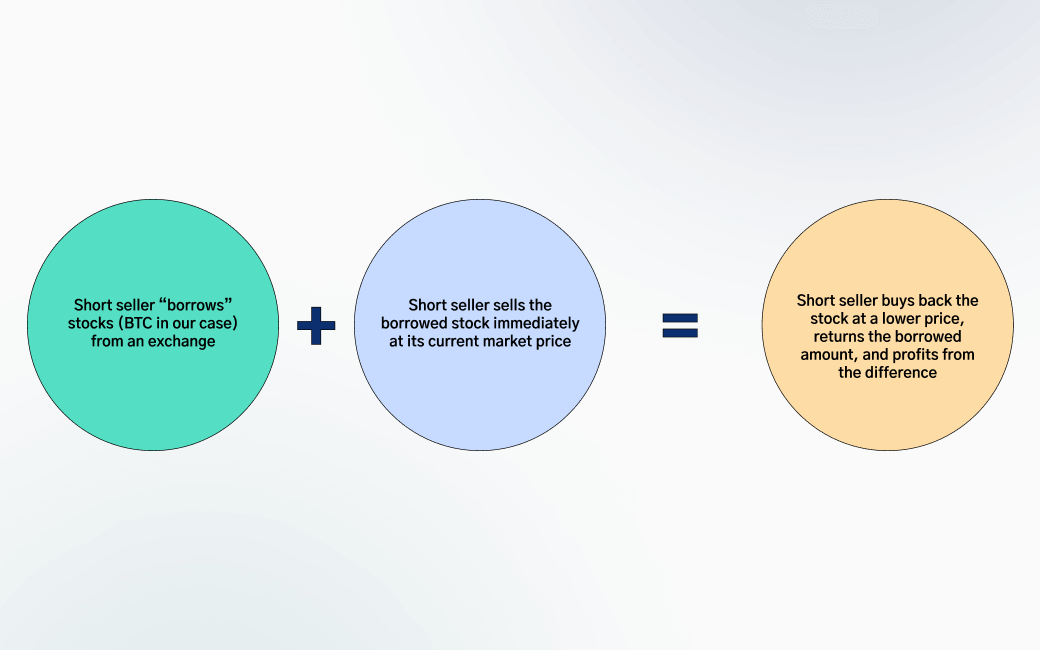

Let’s say you have the view that bitcoin is going to go down in value. The way you should short the coin is by reaching out to your broker and borrowing bitcoin by paying the current market price. At that time, you essentially sell them for the price you paid and you wait for them to drop in value. Let’s say you paid $45,000 for 1 bitcoin.

A few days later you turn out to be right and the coin goes down $5000. What you do when you cover, or close, your short position is to go back in the market and buy them back for $40,000. In practice, you sold the token for $45,000 and repurchased it for $40,000.

That way, you’ve made a profit of $5,000. When you close your position, you’re no longer borrowing the amount from your broker. Essentially, they are in the same place where they started. You might have to pay a certain fee for borrowing the token as they lent it to you. And that’s short selling bitcoin.

Why Should I Short Sell Bitcoin

The more important question, however, is not how but why would you want to short sell bitcoin. Keep in mind, selling bitcoin and short selling bitcoin are two completely different market actions. Selling bitcoin is simply the action you take when you want to get rid of your coins.

Short selling, on the other hand, means you risk losing your money if the price of bitcoin moves up. And this is a crucial factor to weigh in if you’re looking to go short bitcoin.

While it may be tempting to short bitcoin when it’s high, it could actually go higher. And if you open a short position and it does go up, it could go infinitely higher. And while your upside, or profit, is limited, your downside could reach 100% of your account as bitcoin could keep moving higher.

This said, it’s necessary to make a thorough analysis of the price of bitcoin and only go short if you have conviction the price will go down. Otherwise, it may cost you the entire amount of your trading account.

Short Selling Bitcoin Strategies

Short selling bitcoin strategies revolve around analysis of bitcoin’s price based on a variety of factors. To this end, there are two main directions your analysis could go – technical analysis and fundamental analysis.

Technical Analysis

Technical analysis is based on assuming the price could go a certain direction based on where it has been before. In other words, you study the charts, see previous tops and bottoms, patterns and formations, and draw a conclusion.

Your conclusion could lead you to short selling bitcoin if you see an inflection point and expect the trend to turn to the downside. Or you could decide to wait for a stronger chart signal like a multi-year resistance, an all-time high etc.

Regardless, technical analysis allows you to “read the tape”, interpret the chart, pull the trigger, and enter the market.

Fundamental Analysis

In addition to technical analysis, there is fundamental analysis. What it does is it tells you where price may go based on news and reports. Bitcoin, in particular, has been supported by fundamental analysis rather than technical.

This analysis includes news like El Salvador’s push toward bitcoin adoption in September 2021. Another strong fundamental was Tesla’s $1.5 billion bet on bitcoin in February 2021. Or bitcoin endorsements from legendary traders, hedge funds, and institutional investors like Ray Dalio and George Soros.

All this has a profound effect on bitcoin and this is reflected in bitcoin’s price which has skyrocketed boosted by positive fundamentals. With this in mind, you can try and go short bitcoin when there is negative news.

Summary

In conclusion, keep in mind that going short bitcoin might be costly. And while you can certainly reap handsome profits, you risk wiping your entire trading account. To this end, make sure that if you want to short bitcoin, you have researched the market, both technicals and fundamentals, and only then go ahead and short the price of bitcoin.

And finally, know that shorting anything takes courage. Especially something as large, aggressive, and volatile as bitcoin.

FAQ

- What is short selling?

Short selling is opening a short position in the financial markets. It means you sell an asset and expect to profit from the price moving lower.

- Can you short bitcoin?

Yes. You need to find the right broker that allows short positions. Then, you have to do your careful analysis and decide whether you want to short bitcoin. Keep in mind this is a risky trading decision.

- How to short a bitcoin option?

Bitcoin options are derivatives of their underlying asset, bitcoin. Essentially, shorting bitcoin options is done the same way you would short a genuine bitcoin.