Crypto Terminology Explained

Plan

Putting all your money in one coin – buying because it is cheap – not having a plan – not knowing the basics of market analysis – summary

What is the most common crypto term; what does hodl mean, crypto glossary terms

If you think an address is where you live, gas is what you put in your car, and a wallet is the leather thing in your pocket – you are not a crypto trader!

There is one market that makes even expert investors with years under their belts feel confused. Cryptocurrency is a relatively new market, and as an emerging financial asset, there is a sea of acronyms, “coined” (pun intended!) terminology, and industry slang. First, we’ll cover the basics or scroll to the bottom for the handy list.

What Is Cryptocurrency?

Before we delve into the most common crypto terms and phrases, we should ask the question: “What is cryptocurrency?” Cryptocurrencies are digital tokens used to buy goods online or offline, transfer money, save or store money and trade. The early proponents of cryptocurrency came to this concept of “digital money” or electronic cash as a way to manage finances online without the hassle – and expense – of going through a central bank.

Bitcoin was the first cryptocurrency, and technically all the tokens which came thereafter are referred to as “altcoins” (alternative coins). The origins of Bitcoin are shrouded in mystery. Still, the urban legend goes that the inventor of Bitcoin is Satoshi Nakamoto, the author of the original whitepaper that announced the release of the digital currency. Some translators have alleged that Satoshi Nakamoto means “central intelligence” (from the Japanese Satoshi meaning ‘Clear Thinking‘ or “wise” and Nakamoto being ‘one who lives in the middle).

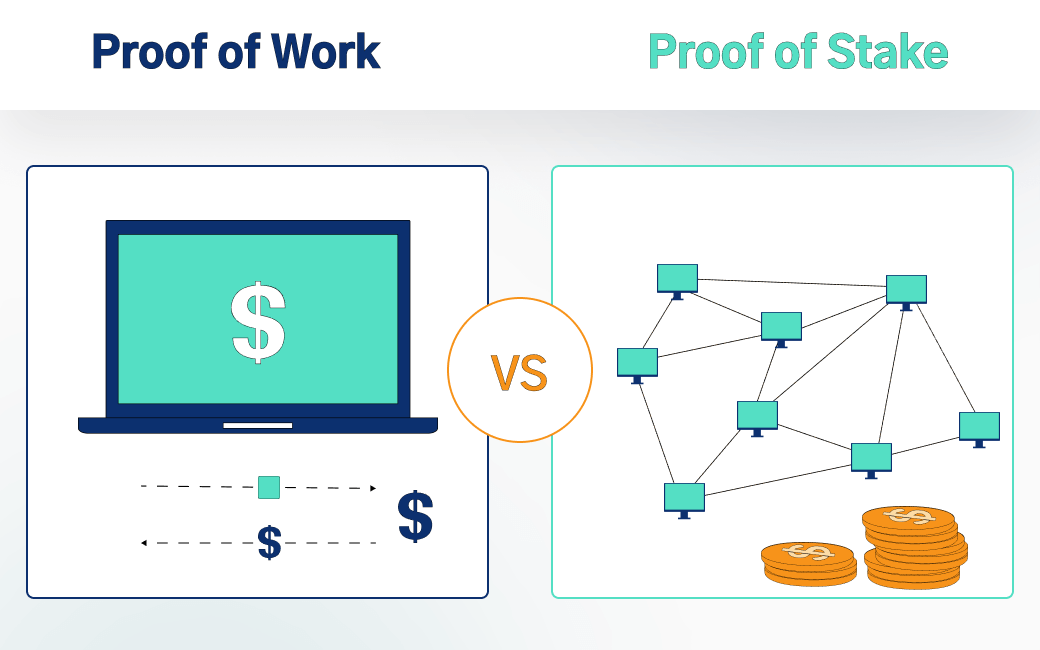

Proof-of-Work vs Proof-of-Stake

Like many of the coins which followed in its wake, Bitcoin is a digital currency built on a decentralized ledger using blockchain technology. Essentially, the electronic transactions are represented by “blocks” of data forming a “chain.” New Bitcoins are “mined” by solving complex cryptographic puzzles, although a finite number can be created overall (21 million Bitcoin, of which around 90% have been mined).

Bitcoin uses what is known as a “proof-of-work” (PoW) algorithm, whereby other members of the community validate new transactions and “miners” are rewarded with new tokens. Subsequent altcoins have adopted a “proof-of-stake” (PoS) algorithm in which the number of tokens a user holds dictates the mining power. The PoS approach is said to overcome some of the environmentalist concerns posed by Bitcoin (which has a carbon footprint equivalent to New Zealand).

Investing In Crypto

Of course, while the teams behind altcoins like Ethereum and Ripple may see their creations as alternative finance on the precipice of taking over traditional banking, the most prominent use of cryptocurrency to date is as an investment. The volatility of the crypto market makes it a lucrative (if risky) asset.

Each financial market comes with new terminology, which may be especially true with cryptocurrency. Ethereum is disrupting crypto with dApp building, but have you stored your ERC-20 in a cold wallet? If this sentence is hard to follow, we have you covered. Here is your crypto glossary:

Crypto Glossary

Address: First up in the crypto glossary is “address”, a term you may have encountered when reading about Bitcoin. In the crypto circuit, the address is the string of characters that operates as a virtual location for blockchain transactions. Akin to an email address, each one is unique and denotes the position of the wallet in question along the blockchain. In the same way, you would send an email to an address such as “[email protected]” you can send Bitcoin (BTC) to an address that looks something like this: 1BvVXSEYstNetqFMFn7Au3e4HJg7xPaQVN2.

Altcoin: As discussed above, any cryptocurrency apart from Bitcoin is referred to as an “altcoin.” There are over 10,000 cryptocurrencies in circulation, only one of which is Bitcoin. The rest are altcoins.

Blockchain: Most cryptocurrencies are built on a decentralized public ledger. In other words, independent data blocks together make up an overall block. Transactions can be verified (and viewed) along the chain, meaning that Bitcoin and similar altcoins are secure but not anonymous. Privacy-centric coins like Monero, however, are more private.

Bitcoin Cash: A more user-friendly version of the alma mater Bitcoin. While the latter is now used primarily as an investment and trading asset, Bitcoin Cash is the go-to option of the two for financial transactions.

dApps: The latest buzzword among crypto disciples, dApps, stands for “decentralized applications.” dApps are open-source applications developed on the blockchain. dApps can be used for real-life scenarios, but they have in common the crypto token incentive alongside the open-source and decentralized nature. Ethereum is considered the pioneer of crypto dApps.

Decentralized: This adjective is often bandied around in the world of cryptocurrency. Decentralized ledger, finance, applications…one of the most significant selling points of these electronic cash tokens is that they operate with circumventing a third party such as a central bank. In other words, they are decentralized.

Decentralized finance (Defi): the blanket term for cryptocurrency or electronic equivalents to traditional finance (insurance, money transfers, banking, etc.).

Digital currency: all cryptocurrencies are digital currencies, but not all digital currencies are cryptocurrencies. Certain official national currencies (“fiat currencies”) have a digital equivalent. Fiat currency with a virtual form is also termed CBDC, “central bank digital currency.”

Gas: Think gas is just for your car? Think again; in the crypto community, “gas” is the fee charged for making a transaction. The miner has a gas price for making a transaction on the blockchain.

ICO: You may have heard of a cryptocurrency having an ICO. This stands for “initial coin offering”, and it is an open project for a new crypto startup to secure funding.

Miner and mining: Bitcoin miners don’t wear hard hats or spend long hours underground. They likely spend significant time indoors and burn through tons of electricity. Mining is the term for approving new transactions on the blockchain and creating new tokens in the process.

Non-fungible tokens (NFTs): NFTs are units of value representing digital assets ownership. Collectable items, including art, music, and even Pokemon cards, can be bought and sold using NFTs.

Private key: The private key is the (both fortunately and annoyingly immemorable) string of letters and numbers that guard the door to your crypto. Fortunately, it is difficult for others to remember, though beware of forgetting it – without it, your crypto riches may be forever inaccessible.

Public key: This string of characters is used within a publicly verifiable crypto transaction.

HODL: This acronym stands for “hold on for dear life” and has become a battle cry among crypto advocates who believe that many altcoins warrant a long-term investment approach of buy and hold instead of speculating on the volatile price changes in the near term.

Smart contracts: Another feature originating from Ethereum, smart contracts are a type of binding agreement in computer code.

Wallet: Not just your leather cardholder, a crypto wallet is a digital store of your tokens. There are “hot” wallets, software applications accessible from any computer with an internet connection, or “cold” wallets through which tokens can be downloaded onto separate hardware.

Whale: A crypto whale is an individual or entity holding enough cryptocurrency to manipulate the market. Bitcoin whales are powerful investors with large amounts of BTC (normally at least 1,000 Bitcoin). Whales hold such vast amounts of crypto that they can make orders of a size to temporarily inflate prices or keep them unnaturally low to influence the market in their favor.

Cryptocurrency Exchange

Now you have your handy crypto glossary by your side, you may be ready to start trading tokens. Before entering the potentially lucrative avenue of crypto speculation, you will need an appropriate trading exchange. Our platform TradeOr meets all your crypto needs and more. TradeOr clients can trade Forex, metals, stocks, and other financial assets alongside a cryptocurrency exchange.

Here at TradeOr, we recognize the inherent risks of crypto trading. Many beginner traders fall at the same stumbling blocks by investing everyone in one coin, choosing cheap tokens or trading without a plan. These common mistakes can make for an expensive learning curve. Therefore, here at TradeOr, we ensure our clients access premium charting software and have the latest market news on their keyboards. The volatility of the cryptocurrency industry means that profits can be dramatic – but losses are reflected accordingly. Trust your funds in expert hands and trade with the best tools at your disposal.

FAQ

- What does HODL mean?

HODL is a popular acronym in crypto circles. It stands for "Hold on for dear life." Once a mantra among certain token enthusiasts who were justifying the choice not to sell their assets. The phrase has become an industry term to describe the investment approach of long-term investment and ignore the price spikes common in the cryptocurrency market.

- What are the most common crypto terms & phrases?

Each financial market has its glossary of industry terms, and cryptocurrency is no exception. If anything, this burgeoning market has an unusually high number of industry-specific terms, many of which may be entirely perplexing to new users and beginner traders. Some of the most common terms include "wallet" (the place you store your tokens) ", mining" (the process of verifying transactions and creating new tokens), and seed or "private key" (the password of encrypted code required to access your cryptocurrency).

- How can crypto terms and phrases help a trader?

An understanding of the crypto lingo can go a long way when buying and selling tokens. Ample research should be undertaken before you invest heavily in any tokens. Communities enthusiastic about the prospects of a certain altcoin (sometimes dubbed the "crypto faithful") may shroud the best advice in industry jargon and slang. Gleaning the most from articles, forums, and token whitepapers requires a basic understanding of crypto terms.