Introduction

Poker players will be no stranger to blue chips – those with the best value on the table. In the world of finance there is a similar term: “blue chip stocks.” This term refers to shares of stable and financially solid companies with long-standing reputations.

Blue chip stocks tend to come from corporations with steady earnings and often with dividend plans. Many traders see investing in blue chip stocks as a safe way to bounce back from a bear market. An added advantage of these companies is the consistent payouts from stable profits and predictable earnings. From the casinos to Wall Street, “blue chip” is a harbinger of profit. Here’s everything you need to know about blue chip stocks.

What Are Blue Chip Stocks?

Blue chips stocks come from companies with reputations of financial stability and regular profits. The shares tend to be issued from large and recognized names which fill investors with confidence through prestige and popularity. Investing in blue chip stocks is a clear route to portfolio diversification, and while these stocks tend to cost more, they are well worth the heavy price tag.

The allure of blue chip stock is the reputation of stability. Blue chip companies are seen as a safe investment during a “bear” market (when prices are on a downward trend). The combination of a sizeable financial footprint, steady earnings, and long-established reputation and management is reassuring to investors. The companies in question are large – think a market capitalization of at least a few billion. Those brand names that are thought of as the “industry leaders” (think Apple for tech and Amazon for retail) are the definition of blue chip stocks.

Characteristics of Blue Chip Companies

Blue chip stocks do not guarantee the volatility of cryptocurrency tokens or a well-timed startup. The appeal of blue chip stock lies in the reliability of the companies, your profit may not make headlines, but they are near guaranteed. By trading or investing in blue chip stocks, you look for a steady return over time, perhaps even decades. Here are the trademarks of blue chip stocks:

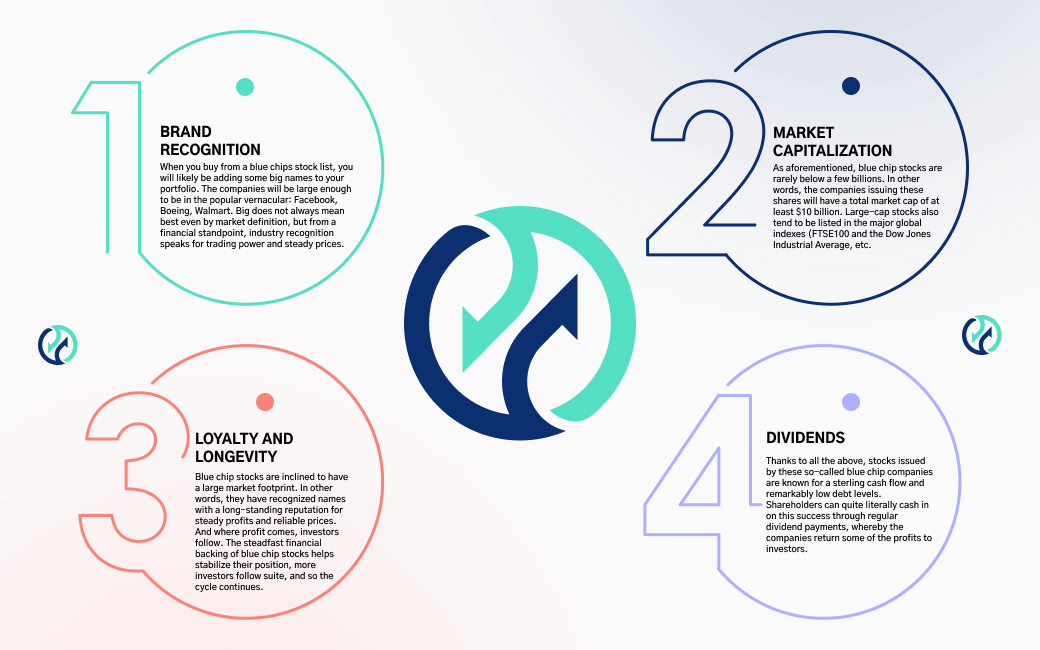

Brand recognition: When you buy from a blue chips stock list, you will likely be adding some big names to your portfolio. The companies will be large enough to be in the popular vernacular: Facebook, Boeing, Walmart. Big does not always mean best even by market definition, but from a financial standpoint, industry recognition speaks for trading power and steady prices.

Market capitalization: As aforementioned, blue chip stocks are rarely below a few billions. In other words, the companies issuing these shares will have a total market cap of at least $10 billion. Large-cap stocks also tend to be listed in the major global indexes (FTSE100 and the Dow Jones Industrial Average, etc.).

Loyalty and longevity: Blue chip stocks are inclined to have a large market footprint. In other words, they have recognized names with a long-standing reputation for steady profits and reliable prices. And where profit comes, investors follow. The steadfast financial backing of blue chip stocks helps stabilize their position, more investors follow suite, and so the cycle continues.

Dividends: Thanks to all the above, stocks issued by these so-called blue chip companies are known for a sterling cash flow and remarkably low debt levels. Shareholders can quite literally cash in on this success through regular dividend payments, whereby the companies return some of the profits to investors.

Blue Chip Dividend Stocks

The size and stability of those companies known for blue chip stocks come with another peak: dividends. Dividends are a way to allocate some company profits, often through quarterly payments. This is different to smaller companies and startups, which would tend to reinvest their earnings internally for a period of growth. Once a company has reached a certain point, they no longer need to spend all their profits investing in themselves and may begin to reward their investors. The age and reputability of companies are an indication they can now afford to pay dividends to their shareholders, another sign of a blue chip stock.

Shareholders benefit from regular dividend payouts through direct portfolio income, alongside the additional benefit of steady income protecting against the effects of inflation and rising prices. investing in blue chip stocks is a popular avenue for long-term investors. Retirees can use dividends to bolster a savings plan, for example. There are also dividend investment plans (DRIPs) that convert dividends into extra blue chip stocks and additional compound returns.

Pros and Cons of Blue Chip Stocks

Blue chip stocks may seem like an obvious choice for traders and investors, but there are downsides to these options. Let’s cover both sides of the coin, starting with the advantages of blue chip stocks:

- Stability: The industry behemoths that issue blue chip stocks are well-known and robust. These companies tend to survive market dips and ride out recessions.

- Dividends: The passive income from dividend payouts makes blue chip stocks highly popular.

- Future growth and longevity: Blue chip companies generally have a promising and long future.

- Passive investment: These types of stock are reasonably safe investments. They do not require the active management and oversight of more volatile securities.

Not all that glisters is gold, however, and here are some of the disadvantages of blue chip stocks:

- Slower growth: The lack of volatility lauded as an upside above can also be seen as disadvantageous. Blue chip companies are well-established and, as such not particularly volatile. This means prices are more stable and returns steadier, but you will not get the exponential growth or drastic returns of more unpredictable companies.

- Expensive: Blue chip stock is more costly than shares issued from less established companies. Nonetheless, there are stock options where you can buy fractions of blue chip stocks or trade through derivatives like ETFs or CFDs.

Good Blue Chip Stocks to Invest In

All the above brings us to the obvious question: what are the best blue chip dividend stocks to invest in? Every industry has its own niche set of blue chip companies. From the Johnson & Johnson of pharmaceuticals, to the Microsoft of software giants, here are the premium picks of blue chip stocks:

Walt Disney Company (DIS): Walt Disney is the Godfather of entertainment, and for good reason. This trade name can be found everywhere from Hollywood to theme parks and cruise ships worldwide. However, investors should be aware that the dividend scheme was paused during the COVID-19 pandemic.

Johnson & Johnson (JNJ): Millions of families will recognize this brand, a household favourite around the world. Much more than shampoo however, Johnson & Johnson has a powerful standing as a pharmaceutical giant (recently solidified by their race to the finish line with a COVID vaccine).

Apple (APPL): No blue chip stocks list would be complete without the tech giant Apple. The ubiquitous apple logo bears testament to this trailblazing company’s influence and financial reputation. As of November 2021, Apple dividends were $0.22 per share.

Alphabet (GOOGL): Alphabet is a tech conglomerate now worth over $1 trillion. As the parent holding company of goliaths Google, Android and Chrome, no wonder Alphabet packs quite the powerful punch. Alphabet is not a dividend stock but is one of the most disruptive stocks, rising 70% in 2021.

How to start investing in blue chip stocks

Once you have a decent understanding of these stocks you may want to start trading or investing in them yourself. You can buy individual stocks or invest in diversified funds such as ETFs (exchange-traded funds). The advantage of the latter option is that it bolsters you against a single company going down and taking your investment with it. Diversified funds allow you to weather the market storms and come out with your portfolio high and dry!

Also known as “index funds”, this diversified allows investors to buy into multiple companies simultaneously. There are many mutual funds investing in blue chip stocks and ETFs available. Blue chip funds tend to see slower daily growth due to their stable market capitalization. If you are a day trader interested in short term methods such as scalping, simply look for a broker which broadens your trading horizons to multiple markets.

Here at TradeOr, we offer a broad range of markets and assets. Trade stocks from the US market, including Apple (AAPL) and Amazon (AMZN). Dip into shares from the European Union with stock from BMW (BMWG) and Siemens (SIEGn). Perhaps you are interested in trading cryptocurrencies and cashing in on this highly volatile market? Whatever your financial interest, we have it all at TradeOr: forex pairs, metals, indices and more. Our platform keeps you updated with real-time financial data to keep your finger on the market pulse. Also, you can sign up for our newsletter, so you never miss a beat!

FAQ

- Are Blue Chips High Risk?

No, blue chips are quite the opposite in fact. Blue-chip stock tends to be issued from low risk and highly reliable companies with stellar reputations and the promise of withstanding market uncertainties.

- Is It Safe To Invest In Blue Chip Stocks?

While no investment is 100% risk-free, blue-chip stocks are certainly a low risk and less volatile choice. These companies are assumed to be a type of “safe haven” for investors and project a moderate but continuous growth.

- What Are Blue Chip Stocks?

Blue-chip stocks are shares of large companies (often with market capitalizations of tens of billions of dollars). Taking their name from the blue chip in poker, which holds the highest value, stock from these companies tends to be a safe investment for long-term growth.